Summary

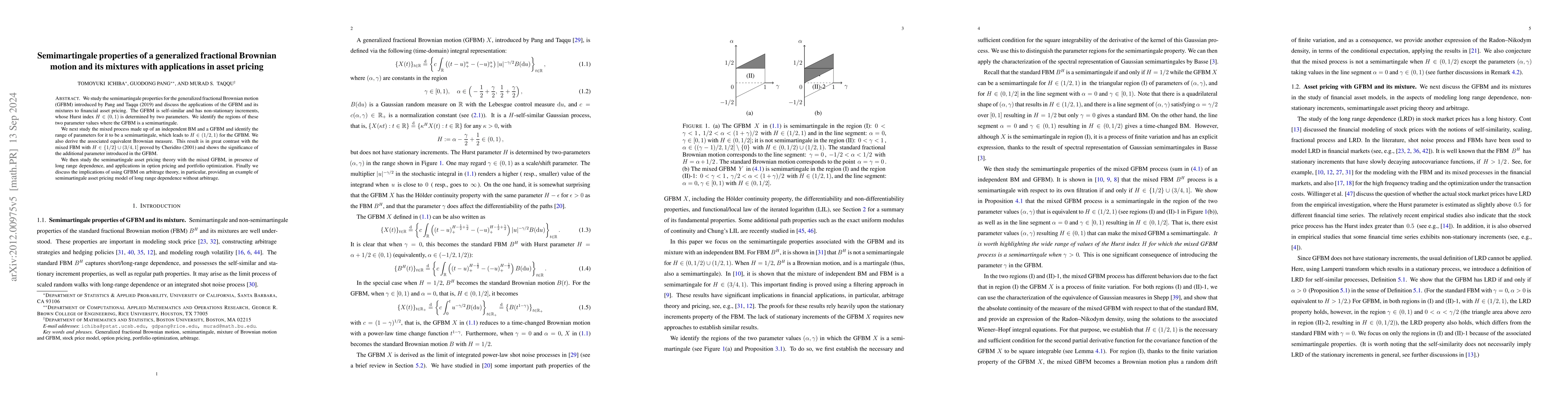

We study the semimartingale properties for the generalized fractional Brownian motion (GFBM) introduced by Pang and Taqqu (2019) and discuss the applications of the GFBM and its mixtures to financial asset pricing. The GFBM is self-similar and has non-stationary increments, whose Hurst index $H \in (0,1)$ is determined by two parameters. We identify the regions of these two parameter values where the GFBM is a semimartingale. Specifically, in one region resulting in $H\in (1/2,1)$, it is in fact a process of finite variation and differentiable, and in another region also resulting in $H\in (1/2,1)$ it is not a semimartingale. For regions resulting in $H \in (0,1/2]$ except a line segment resulting in the standard Brownian motion and time-changed Brownian motion cases, the GFBM is also not a semimartingale. We next show that the mixed process made up of an independent BM and a GFBM is a semimartingale when the parameters lie in the two regions aforementioned resulting in $H \in (1/2,1)$ for the GFBM, as well as when the parameters lie in the line segment resulting in a standard BM or time-changed BM with $H \in (0,1/2]$ for the GFBM. We derive the associated equivalent Brownian measure in the cases when $H\in (1/2,1)$. } This result is in great contrast with the mixed FBM with $H \in \{1/2\}\cup(3/4,1]$ proved by Cheridito (2001) and shows the significance of the additional parameter introduced in the GFBM. We then study the semimartingale asset pricing theory with the mixed GFBM, in presence of long range dependence, and discuss the implications of using GFBM on arbitrage theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)