Summary

We investigate the extent to which price updates can increase the revenue of a seller with little prior information on demand. We study prior-free revenue maximization for a seller with unlimited supply of n item types facing m myopic buyers present for k < log n days. For the static (k = 1) case, Balcan et al. [2] show that one random item price (the same on each item) yields revenue within a \Theta(log m + log n) factor of optimum and this factor is tight. We define the hereditary maximizers property of buyer valuations (satisfied by any multi-unit or gross substitutes valuation) that is sufficient for a significant improvement of the approximation factor in the dynamic (k > 1) setting. Our main result is a non-increasing, randomized, schedule of k equal item prices with expected revenue within a O((log m + log n) / k) factor of optimum for private valuations with hereditary maximizers. This factor is almost tight: we show that any pricing scheme over k days has a revenue approximation factor of at least (log m + log n) / (3k). We obtain analogous matching lower and upper bounds of \Theta((log n) / k) if all valuations have the same maximum. We expect our upper bound technique to be of broader interest; for example, it can significantly improve the result of Akhlaghpour et al. [1]. We also initiate the study of revenue maximization given allocative externalities (i.e. influences) between buyers with combinatorial valuations. We provide a rather general model of positive influence of others' ownership of items on a buyer's valuation. For affine, submodular externalities and valuations with hereditary maximizers we present an influence-and-exploit (Hartline et al. [13]) marketing strategy based on our algorithm for private valuations. This strategy preserves our approximation factor, despite an affine increase (due to externalities) in the optimum revenue.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

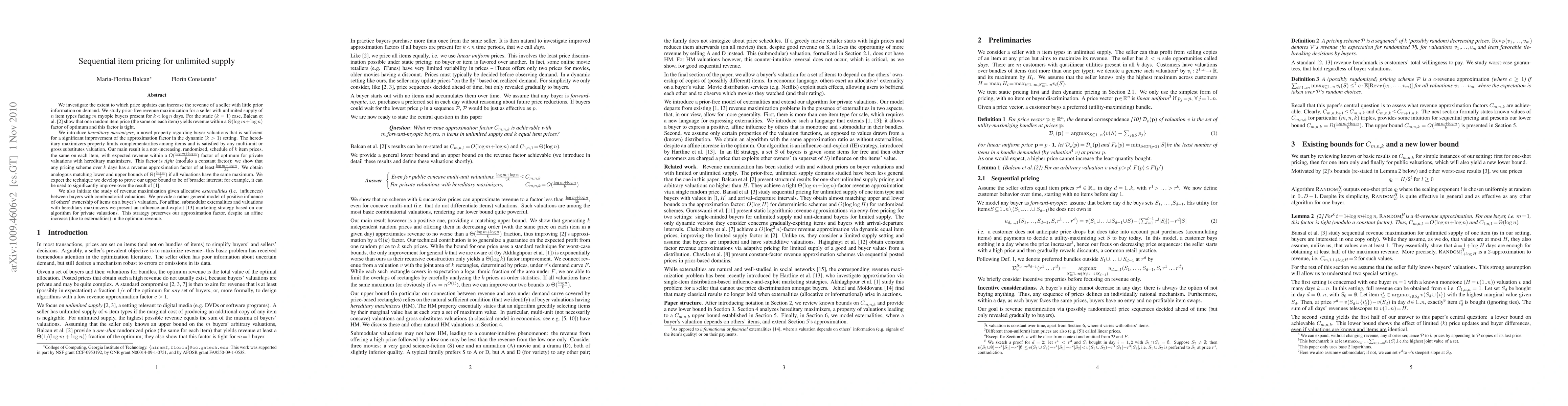

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)