Summary

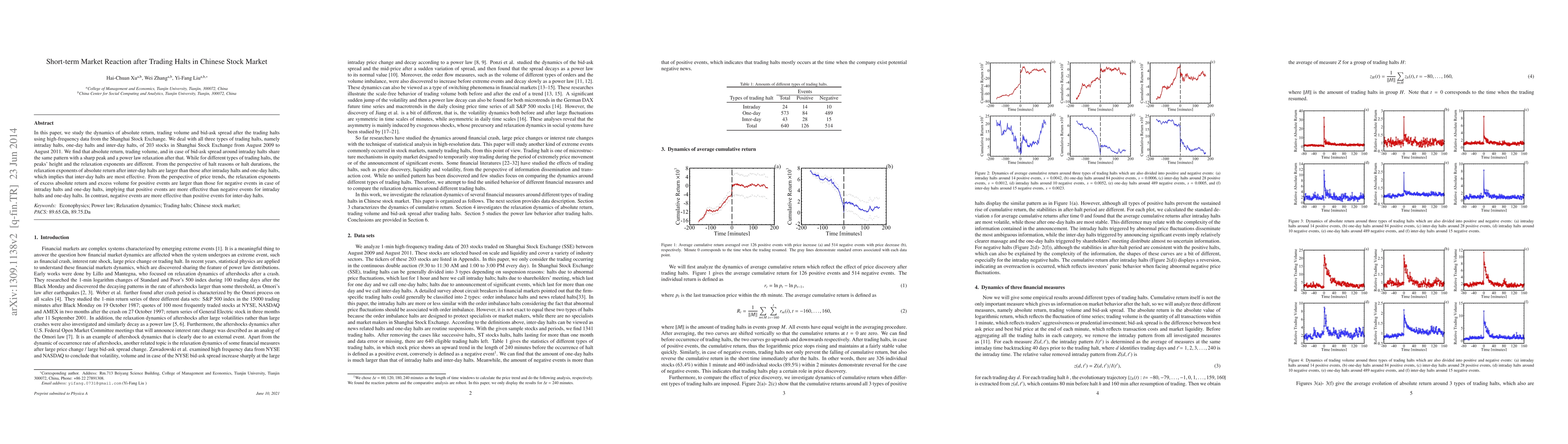

In this paper, we study the dynamics of absolute return, trading volume and bid-ask spread after the trading halts using high-frequency data from the Shanghai Stock Exchange. We deal with all three types of trading halts, namely intraday halts, one-day halts and inter-day halts, of 203 stocks in Shanghai Stock Exchange from August 2009 to August 2011. We find that absolute return, trading volume, and in case of bid-ask spread around intraday halts share the same pattern with a sharp peak and a power law relaxation after that. While for different types of trading halts, the peaks' height and the relaxation exponents are different. From the perspective of halt reasons or halt duration, the relaxation exponents of absolute return after inter-day halts are larger than that after intraday halts and one-day halts, which implies that inter-day halts are most effective. From the perspective of price trends, the relaxation exponents of excess absolute return and excess volume for positive events are larger than that for negative events in case of intraday halts and one-day halts, implying that positive events are more effective than negative events for intraday halts and one-day halts. In contrast, negative events are more effective than positive events for inter-day halts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)