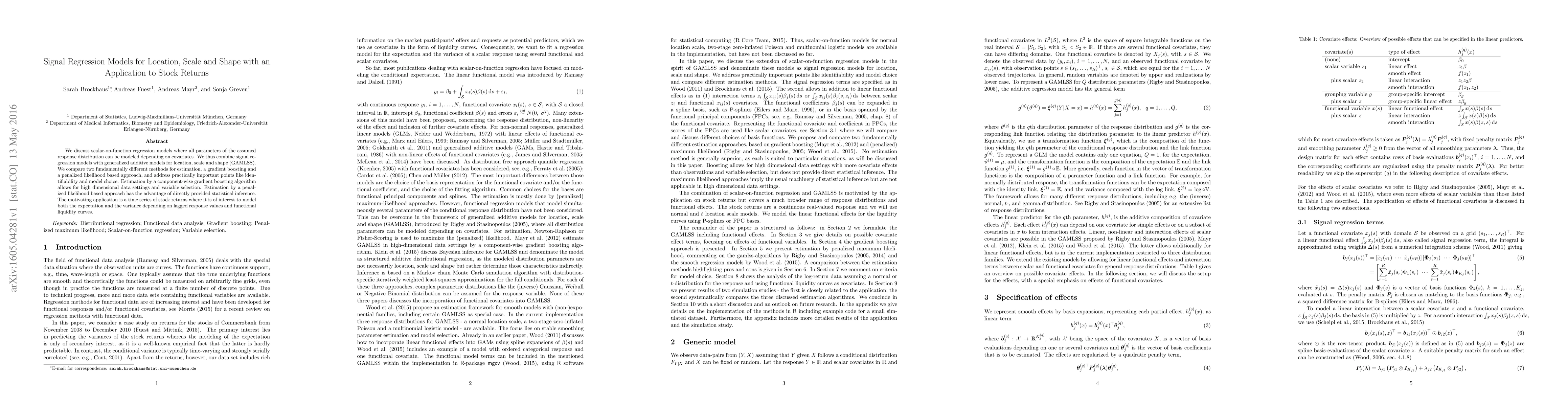

Summary

We discuss scalar-on-function regression models where all parameters of the assumed response distribution can be modeled depending on covariates. We thus combine signal regression models with generalized additive models for location, scale and shape (GAMLSS). We compare two fundamentally different methods for estimation, a gradient boosting and a penalized likelihood based approach, and address practically important points like identifiability and model choice. Estimation by a component-wise gradient boosting algorithm allows for high dimensional data settings and variable selection. Estimation by a penalized likelihood based approach has the advantage of directly provided statistical inference. The motivating application is a time series of stock returns where it is of interest to model both the expectation and the variance depending on lagged response values and functional liquidity curves.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistribution-Free Location-Scale Regression

Lucas Kook, Sandra Siegfried, Torsten Hothorn

Regression and Forecasting of U.S. Stock Returns Based on LSTM

Rong Zhang, Qinyan Shen, Shicheng Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)