Summary

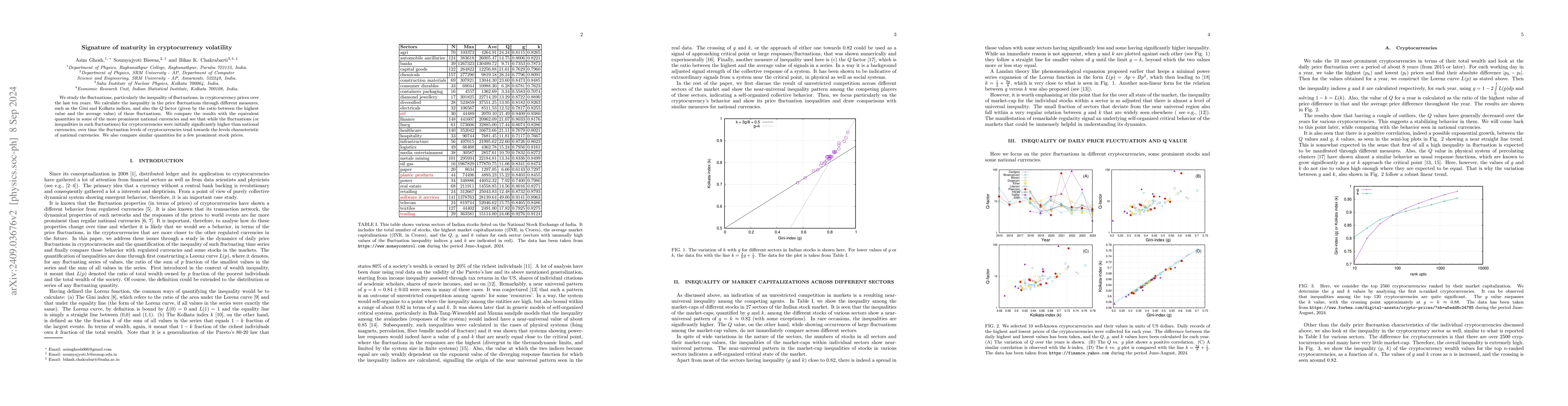

We study the fluctuations, particularly the inequality of fluctuations, in cryptocurrency prices over the last ten years. We calculate the inequality in the price fluctuations through different measures, such as the Gini and Kolkata indices, and also the $Q$ factor (given by the ratio between the highest value and the average value) of these fluctuations. We compare the results with the equivalent quantities in some of the more prominent national currencies and see that while the fluctuations (or inequalities in such fluctuations) for cryptocurrencies were initially significantly higher than national currencies, over time the fluctuation levels of cryptocurrencies tend towards the levels characteristic of national currencies. We also compare similar quantities for a few prominent stock prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-maturity Asian options in local-stochastic volatility models

Dan Pirjol, Lingjiong Zhu

Pricing and hedging short-maturity Asian options in local volatility models

Jaehyun Kim, Hyungbin Park, Jonghwa Park

Short-maturity options on realized variance in local-stochastic volatility models

Xiaoyu Wang, Dan Pirjol, Lingjiong Zhu

No citations found for this paper.

Comments (0)