Authors

Summary

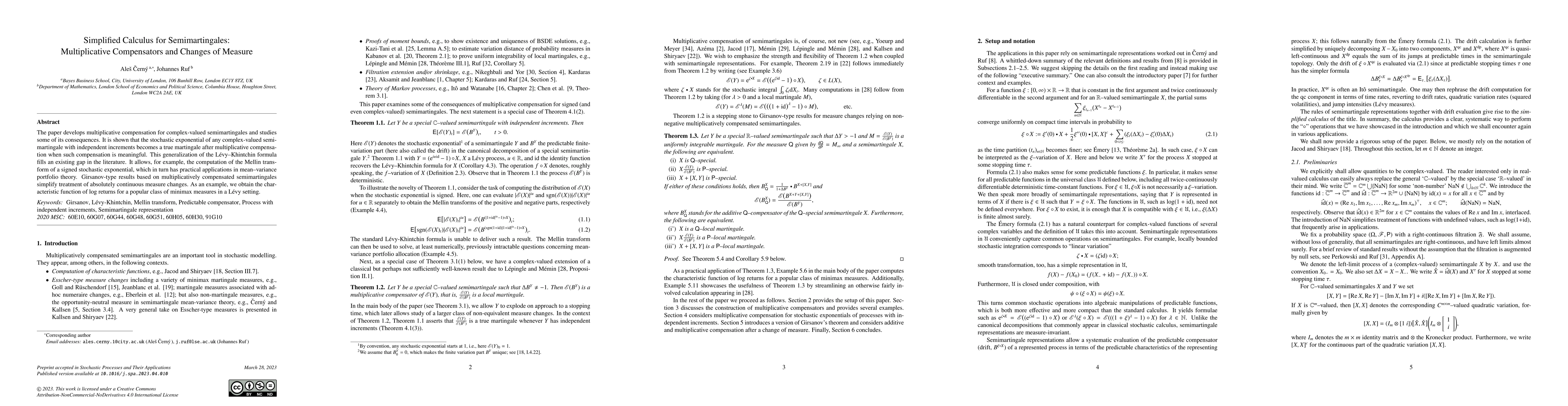

The paper develops multiplicative compensation for complex-valued semimartingales and studies some of its consequences. It is shown that the stochastic exponential of any complex-valued semimartingale with independent increments becomes a true martingale after multiplicative compensation when such compensation is meaningful. This generalization of the L\'evy--Khintchin formula fills an existing gap in the literature. It allows, for example, the computation of the Mellin transform of a signed stochastic exponential, which in turn has practical applications in mean--variance portfolio theory. Girsanov-type results based on multiplicatively compensated semimartingales simplify treatment of absolutely continuous measure changes. As an example, we obtain the characteristic function of log returns for a popular class of minimax measures in a L\'evy setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo arbitrage and multiplicative special semimartingales

Eckhard Platen, Stefan Tappe

Simplified stochastic calculus via semimartingale representations

Aleš Černý, Johannes Ruf

| Title | Authors | Year | Actions |

|---|

Comments (0)