Authors

Summary

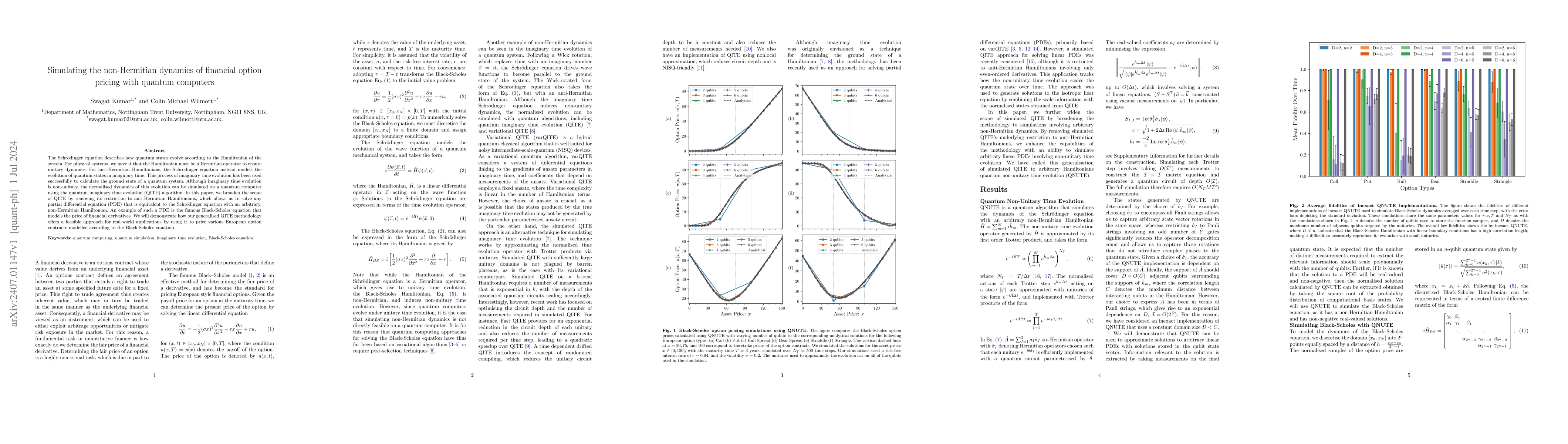

The Schrodinger equation describes how quantum states evolve according to the Hamiltonian of the system. For physical systems, we have it that the Hamiltonian must be a Hermitian operator to ensure unitary dynamics. For anti-Hermitian Hamiltonians, the Schrodinger equation instead models the evolution of quantum states in imaginary time. This process of imaginary time evolution has been used successfully to calculate the ground state of a quantum system. Although imaginary time evolution is non-unitary, the normalised dynamics of this evolution can be simulated on a quantum computer using the quantum imaginary time evolution (QITE) algorithm. In this paper, we broaden the scope of QITE by removing its restriction to anti-Hermitian Hamiltonians, which allows us to solve any partial differential equation (PDE) that is equivalent to the Schrodinger equation with an arbitrary, non-Hermitian Hamiltonian. An example of such a PDE is the famous Black-Scholes equation that models the price of financial derivatives. We will demonstrate how our generalised QITE methodology offers a feasible approach for real-world applications by using it to price various European option contracts modelled according to the Black-Scholes equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReal Option Pricing using Quantum Computers

Álvaro Leitao, Carlos Vázquez, Andrés Gómez et al.

Time series generation for option pricing on quantum computers using tensor network

Koichi Miyamoto, Nozomu Kobayashi, Yoshiyuki Suimon

No citations found for this paper.

Comments (0)