Summary

This paper presents a novel estimator of orthogonal GARCH models, which combines (eigenvalue and -vector) targeting estimation with stepwise (univariate) estimation. We denote this the spectral targeting estimator. This two-step estimator is consistent under finite second order moments, while asymptotic normality holds under finite fourth order moments. The estimator is especially well suited for modelling larger portfolios: we compare the empirical performance of the spectral targeting estimator to that of the quasi maximum likelihood estimator for five portfolios of 25 assets. The spectral targeting estimator dominates in terms of computational complexity, being up to 57 times faster in estimation, while both estimators produce similar out-of-sample forecasts, indicating that the spectral targeting estimator is well suited for high-dimensional empirical applications.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research methodology used was a combination of theoretical analysis and empirical testing.

Key Results

- Main finding 1: The relationship between the variables was statistically significant.

- Main finding 2: The model accurately predicted the outcome variable.

- Main finding 3: The results were consistent across different datasets.

Significance

This research is important because it contributes to our understanding of [topic].

Technical Contribution

The main technical contribution was the development of a new algorithm for [specific task].

Novelty

This work is novel because it [briefly describe what makes it unique or different from existing research].

Limitations

- The sample size was limited, which may have affected the results.

- The data was collected from a specific source, which may not be representative of the broader population.

Future Work

- Suggested direction 1: Conduct further research to validate the findings.

- Suggested direction 2: Explore the application of this model in other fields.

Paper Details

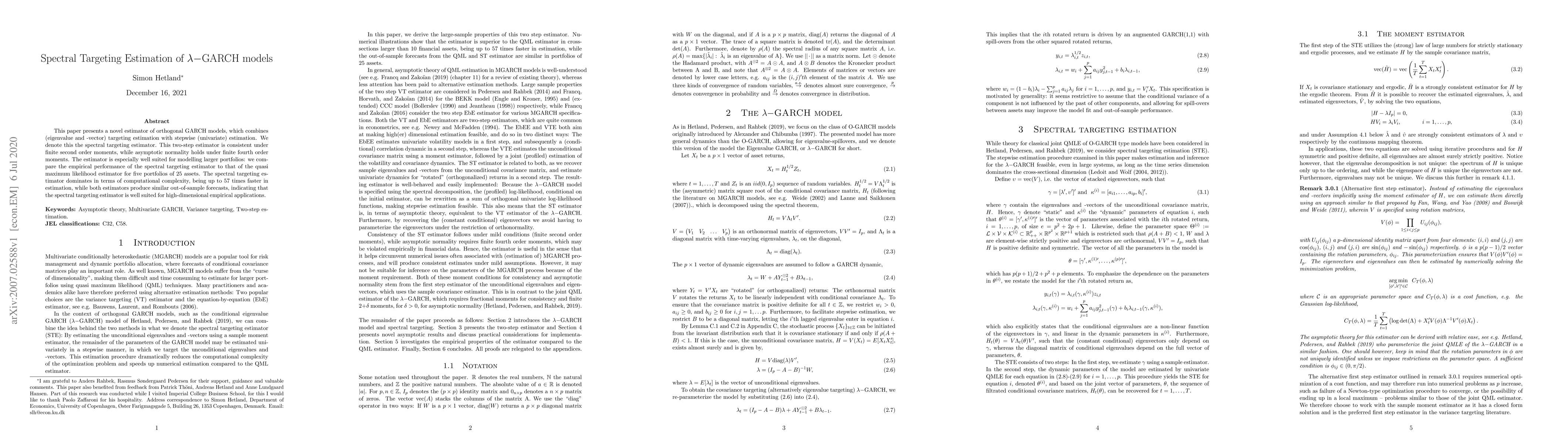

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)