Summary

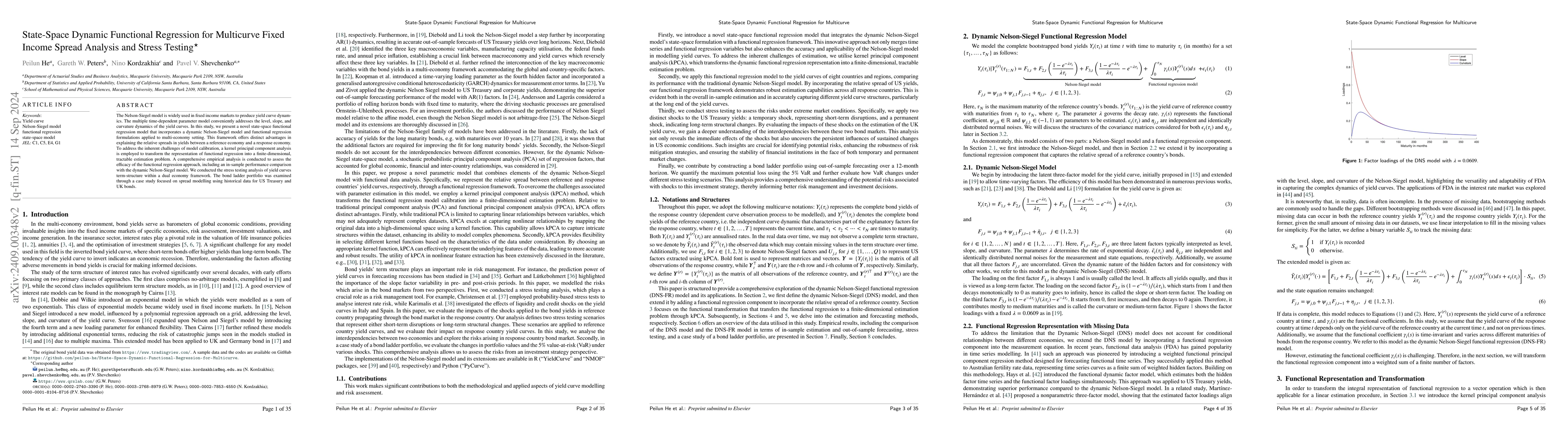

The Nelson-Siegel model is widely used in fixed income markets to produce yield curve dynamics. The multiple time-dependent parameter model conveniently addresses the level, slope, and curvature dynamics of the yield curves. In this study, we present a novel state-space functional regression model that incorporates a dynamic Nelson-Siegel model and functional regression formulations applied to multi-economy setting. This framework offers distinct advantages in explaining the relative spreads in yields between a reference economy and a response economy. To address the inherent challenges of model calibration, a kernel principal component analysis is employed to transform the representation of functional regression into a finite-dimensional, tractable estimation problem. A comprehensive empirical analysis is conducted to assess the efficacy of the functional regression approach, including an in-sample performance comparison with the dynamic Nelson-Siegel model. We conducted the stress testing analysis of yield curves term-structure within a dual economy framework. The bond ladder portfolio was examined through a case study focused on spread modelling using historical data for US Treasury and UK bonds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Infection Spread Model Based Group Testing

Sennur Ulukus, Batuhan Arasli

Testing exogeneity in the functional linear regression model

Carsten Jentsch, Manuela Dorn, Melanie Birke

No citations found for this paper.

Comments (0)