Summary

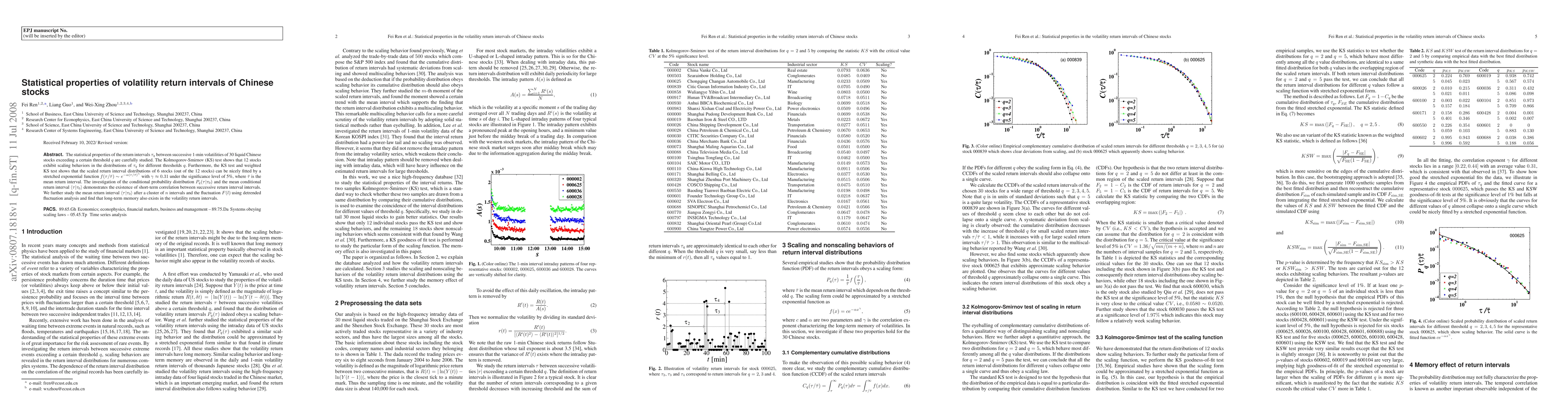

The statistical properties of the return intervals $\tau_q$ between successive 1-min volatilities of 30 liquid Chinese stocks exceeding a certain threshold $q$ are carefully studied. The Kolmogorov-Smirnov (KS) test shows that 12 stocks exhibit scaling behaviors in the distributions of $\tau_q$ for different thresholds $q$. Furthermore, the KS test and weighted KS test shows that the scaled return interval distributions of 6 stocks (out of the 12 stocks) can be nicely fitted by a stretched exponential function $f(\tau/\bar{\tau})\sim e^{- \alpha (\tau/\bar{\tau})^{\gamma}}$ with $\gamma\approx0.31$ under the significance level of 5%, where $\bar{\tau}$ is the mean return interval. The investigation of the conditional probability distribution $P_q(\tau | \tau_0)$ and the mean conditional return interval $<\tau| \tau_0>$ demonstrates the existence of short-term correlation between successive return interval intervals. We further study the mean return interval $<\tau| \tau_0>$ after a cluster of $n$ intervals and the fluctuation $F(l)$ using detrended fluctuation analysis and find that long-term memory also exists in the volatility return intervals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)