Summary

In this paper, we propose a numerical methodology for finding the closed-loop Nash equilibrium of stochastic delay differential games through deep learning. These games are prevalent in finance and economics where multi-agent interaction and delayed effects are often desired features in a model, but are introduced at the expense of increased dimensionality of the problem. This increased dimensionality is especially significant as that arising from the number of players is coupled with the potential infinite dimensionality caused by the delay. Our approach involves parameterizing the controls of each player using distinct recurrent neural networks. These recurrent neural network-based controls are then trained using a modified version of Brown's fictitious play, incorporating deep learning techniques. To evaluate the effectiveness of our methodology, we test it on finance-related problems with known solutions. Furthermore, we also develop new problems and derive their analytical Nash equilibrium solutions, which serve as additional benchmarks for assessing the performance of our proposed deep learning approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

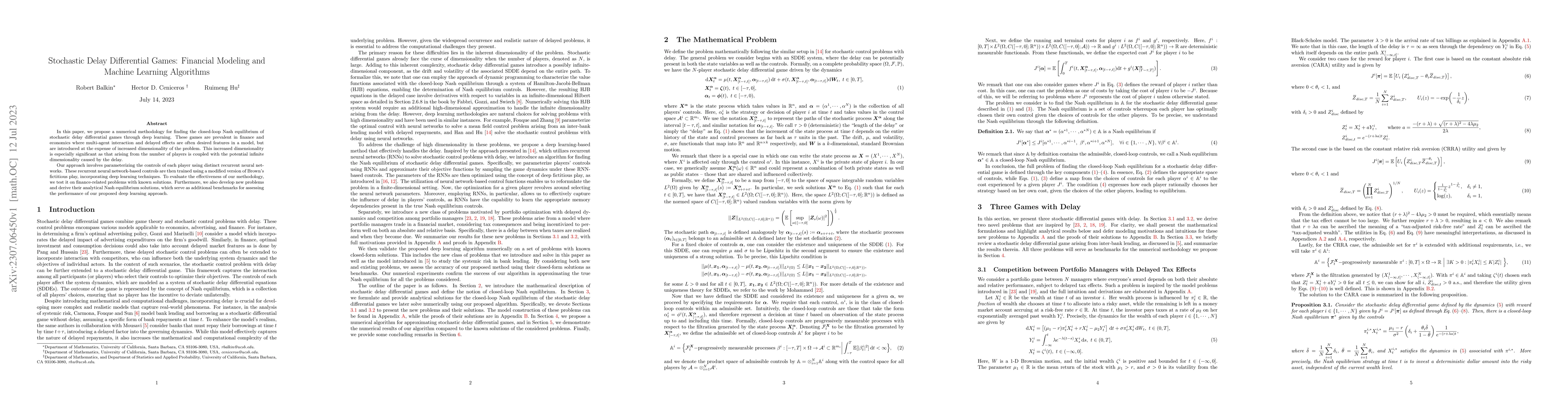

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)