Authors

Summary

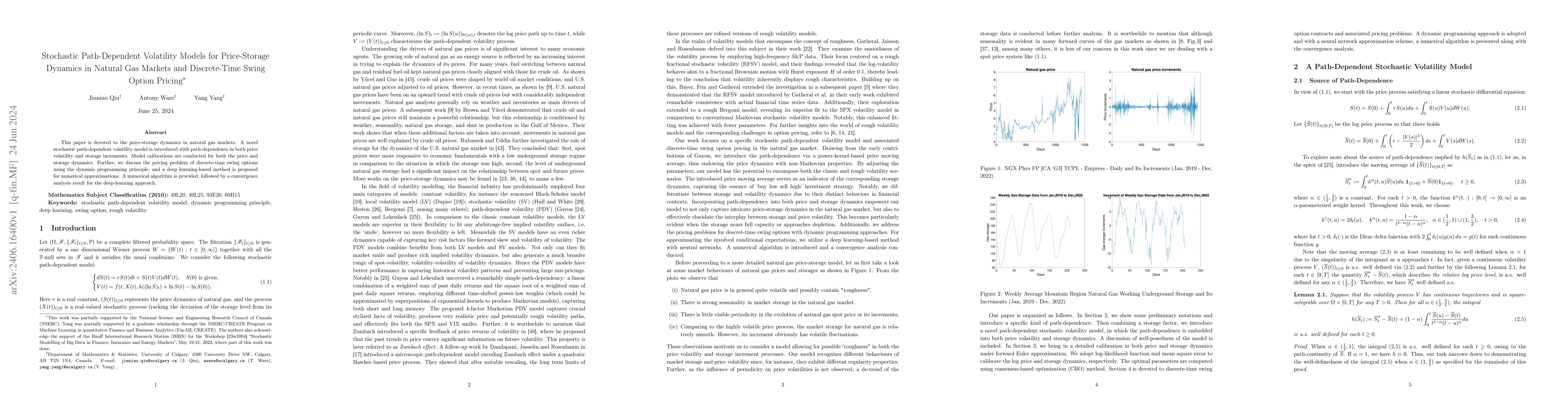

This paper is devoted to the price-storage dynamics in natural gas markets. A novel stochastic path-dependent volatility model is introduced with path-dependence in both price volatility and storage increments. Model calibrations are conducted for both the price and storage dynamics. Further, we discuss the pricing problem of discrete-time swing options using the dynamic programming principle, and a deep learning-based method is proposed for numerical approximations. A numerical algorithm is provided, followed by a convergence analysis result for the deep-learning approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)