Authors

Summary

We conduct modeling of the price dynamics following order flow imbalance in market microstructure and apply the model to the analysis of Chinese CSI 300 Index Futures. There are three findings. The first is that the order flow imbalance is analogous to a shock to the market. Unlike the common practice of using Hawkes processes, we model the impact of order flow imbalance as an Ornstein-Uhlenbeck process with memory and mean-reverting characteristics driven by a jump-type L\'evy process. Motivated by the empirically stable correlation between order flow imbalance and contemporaneous price changes, we propose a modified asset price model where the drift term of canonical geometric Brownian motion is replaced by an Ornstein-Uhlenbeck process. We establish stochastic differential equations and derive the logarithmic return process along with its mean and variance processes under initial boundary conditions, and evolution of cost-effectiveness ratio with order flow imbalance as the trading trigger point, termed as the quasi-Sharpe ratio or response ratio. Secondly, our results demonstrate horizon-dependent heterogeneity in how conventional metrics interact with order flow imbalance. This underscores the critical role of forecast horizon selection for strategies. Thirdly, we identify regime-dependent dynamics in the memory and forecasting power of order flow imbalance. This taxonomy provides both a screening protocol for existing indicators and an ex-ante evaluation paradigm for novel metrics.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research models price dynamics following order flow imbalance using stochastic differential equations, specifically an Ornstein-Uhlenbeck process with memory and mean-reverting characteristics driven by a jump-type Lévy process, replacing the drift term of canonical geometric Brownian motion with this Ornstein-Uhlenbeck process.

Key Results

- Order flow imbalance is modeled as a shock to the market, analogous to an Ornstein-Uhlenbeck process with memory and mean-reverting properties.

- Horizon-dependent heterogeneity in the interaction of conventional metrics with order flow imbalance highlights the importance of forecast horizon selection for trading strategies.

- Regime-dependent dynamics in the memory and forecasting power of order flow imbalance provide a taxonomy for screening existing indicators and evaluating novel metrics.

Significance

This research is significant as it offers a new perspective on modeling price dynamics in response to order flow imbalance, emphasizing the role of forecast horizon selection and regime-dependent dynamics, which can enhance trading strategies and risk management in futures markets.

Technical Contribution

The paper presents a novel modified asset price model incorporating an Ornstein-Uhlenbeck process to capture the mean-reverting characteristics of order flow imbalance, along with deriving the logarithmic return process, its mean and variance, and the quasi-Sharpe ratio.

Novelty

The research distinguishes itself by proposing a memory-driven Ornstein-Uhlenbeck process to model order flow imbalance, contrasting with traditional Hawkes processes, and by identifying regime-dependent dynamics in order flow imbalance, offering a new framework for evaluating trading strategies.

Limitations

- The study focuses on CSI 300 Index Futures, so findings may not be universally applicable to other markets without further validation.

- Reliance on historical data and model assumptions may limit the generalizability of results to unseen market conditions.

Future Work

- Extending the model to other financial instruments and markets for broader applicability.

- Investigating the impact of additional market factors, such as volatility and liquidity, on order flow imbalance dynamics.

Paper Details

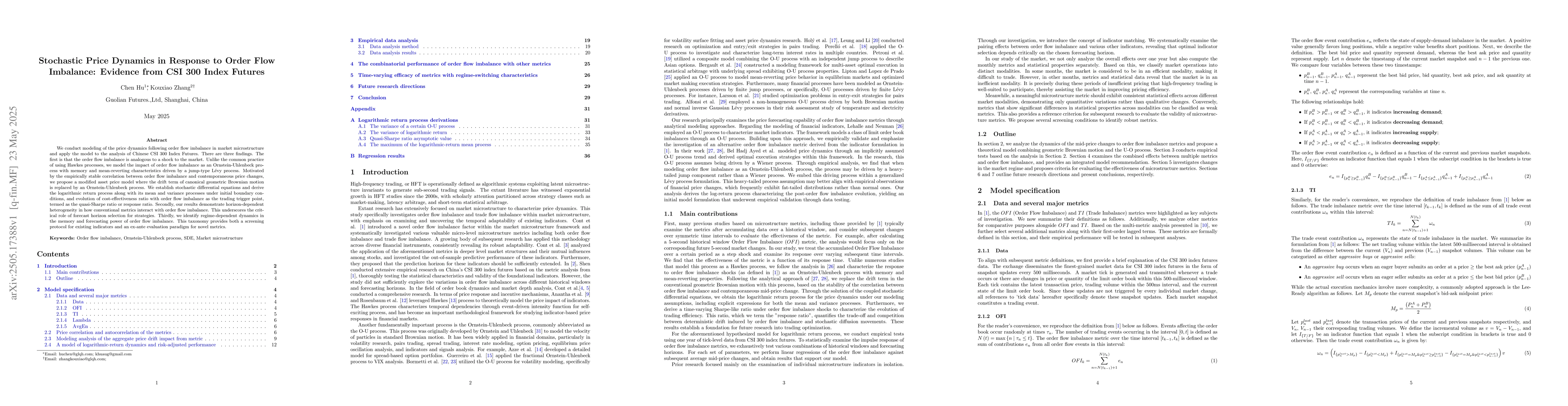

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)