Summary

Financial networks have become extremely useful in characterizing the structure of complex financial systems. Meanwhile, the time evolution property of the stock markets can be described by temporal networks. We utilize the temporal network framework to characterize the time-evolving correlation-based networks of stock markets. The market instability can be detected by the evolution of the topology structure of the financial networks. We employ the temporal centrality as a portfolio selection tool. Those portfolios, which are composed of peripheral stocks with low temporal centrality scores, have consistently better performance under different portfolio optimization schemes, suggesting that the temporal centrality measure can be used as new portfolio optimization and risk management tools. Our results reveal the importance of the temporal attributes of the stock markets, which should be taken serious consideration in real life applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

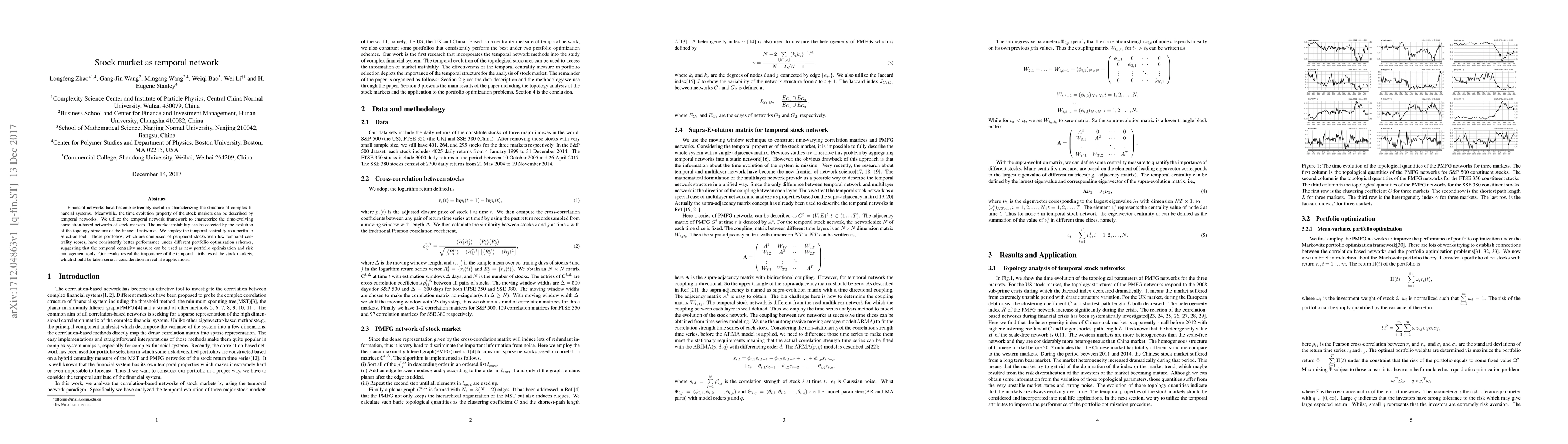

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)