Summary

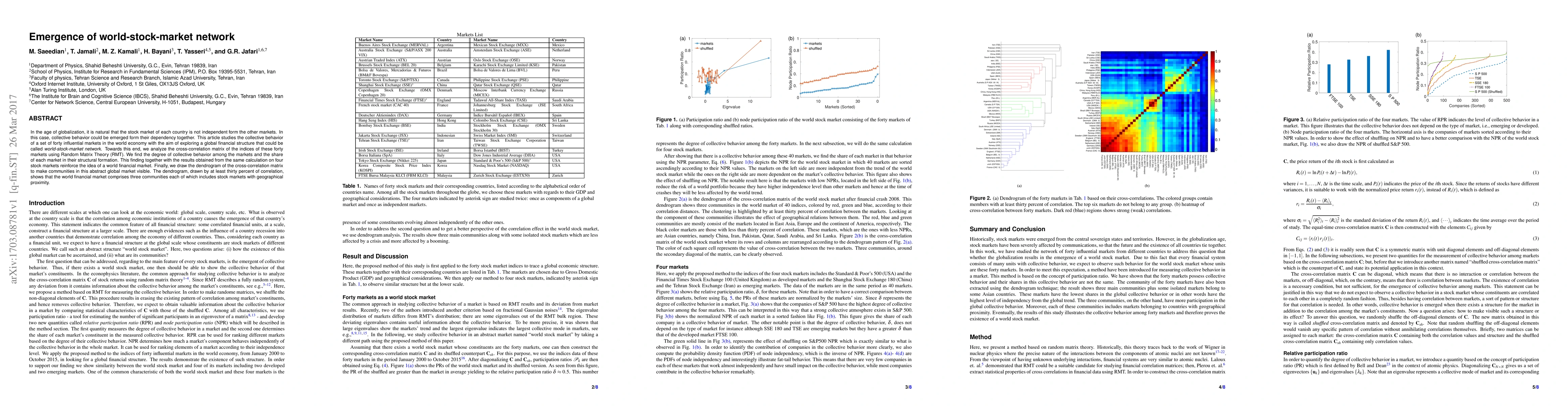

In the age of globalization, it is natural that the stock market of each country is not independent form the other markets. In this case, collective behavior could be emerged form their dependency together. This article studies the collective behavior of a set of forty influential markets in the world economy with the aim of exploring a global financial structure that could be called world-stock-market network. Towards this end, we analyze the cross-correlation matrix of the indices of these forty markets using Random Matrix Theory (RMT). We find the degree of collective behavior among the markets and the share of each market in their structural formation. This finding together with the results obtained from the same calculation on four stock markets reinforce the idea of a world financial market. Finally, we draw the dendrogram of the cross-correlation matrix to make communities in this abstract global market visible. The dendrogram, drawn by at least thirty percent of correlation, shows that the world financial market comprises three communities each of which includes stock markets with geographical proximity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)