Summary

We consider the problem of dynamic buying and selling of shares from a collection of $N$ stocks with random price fluctuations. To limit investment risk, we place an upper bound on the total number of shares kept at any time. Assuming that prices evolve according to an ergodic process with a mild decaying memory property, and assuming constraints on the total number of shares that can be bought and sold at any time, we develop a trading policy that comes arbitrarily close to achieving the profit of an ideal policy that has perfect knowledge of future events. Proximity to the optimal profit comes with a corresponding tradeoff in the maximum required stock level and in the timescales associated with convergence. We then consider arbitrary (possibly non-ergodic) price processes, and show that the same algorithm comes close to the profit of a frame based policy that can look a fixed number of slots into the future. Our analysis uses techniques of Lyapunov Optimization that we originally developed for stochastic network optimization problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

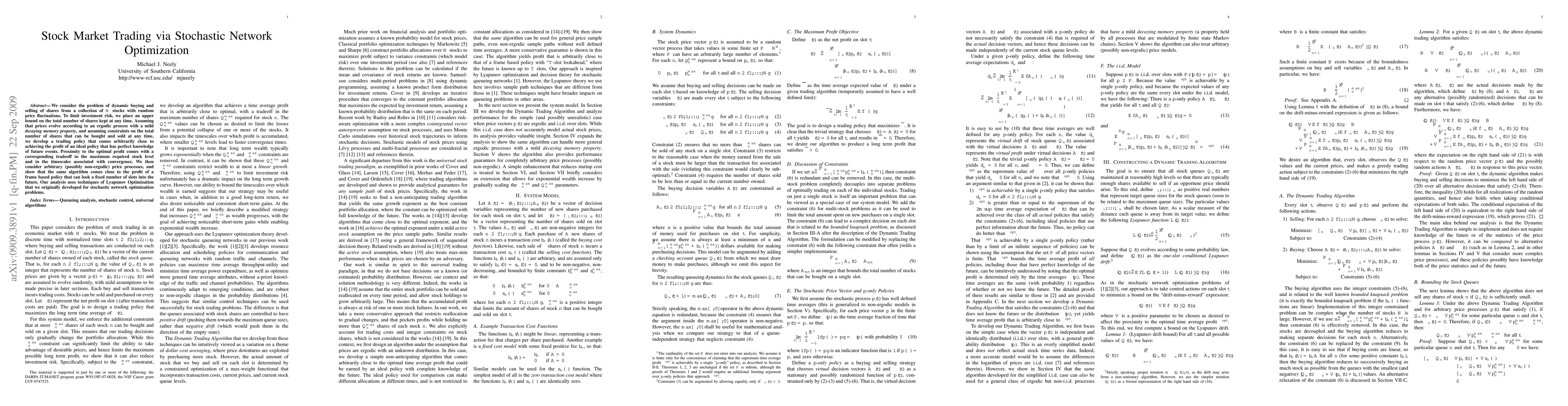

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)