Authors

Summary

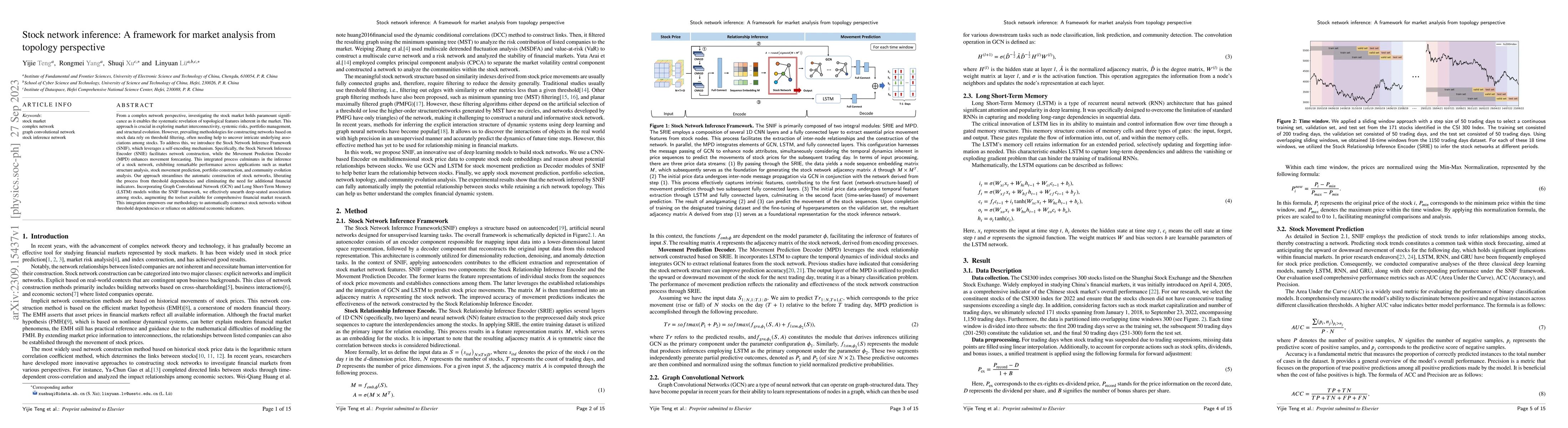

From a complex network perspective, investigating the stock market holds paramount significance as it enables the systematic revelation of topological features inherent in the market. This approach is crucial in exploring market interconnectivity, systemic risks, portfolio management, and structural evolution. However, prevailing methodologies for constructing networks based on stock data rely on threshold filtering, often needing help to uncover intricate underlying associations among stocks. To address this, we introduce the Stock Network Inference Framework (SNIF), which leverages a self-encoding mechanism. Specifically, the Stock Network Inference Encoder (SNIE) facilitates network construction, while the Movement Prediction Decoder (MPD) enhances movement forecasting. This integrated process culminates in the inference of a stock network, exhibiting remarkable performance across applications such as market structure analysis, stock movement prediction, portfolio construction, and community evolution analysis. Our approach streamlines the automatic construction of stock networks, liberating the process from threshold dependencies and eliminating the need for additional financial indicators. Incorporating Graph Convolutional Network (GCN) and Long Short-Term Memory (LSTM) models within the SNIF framework, we effectively unearth deep-seated associations among stocks, augmenting the toolset available for comprehensive financial market research. This integration empowers our methodology to automatically construct stock networks without threshold dependencies or reliance on additional economic indicators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)