Summary

In this work we use Recurrent Neural Networks and Multilayer Perceptrons to predict NYSE, NASDAQ and AMEX stock prices from historical data. We experiment with different architectures and compare data normalization techniques. Then, we leverage those findings to question the efficient-market hypothesis through a formal statistical test.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

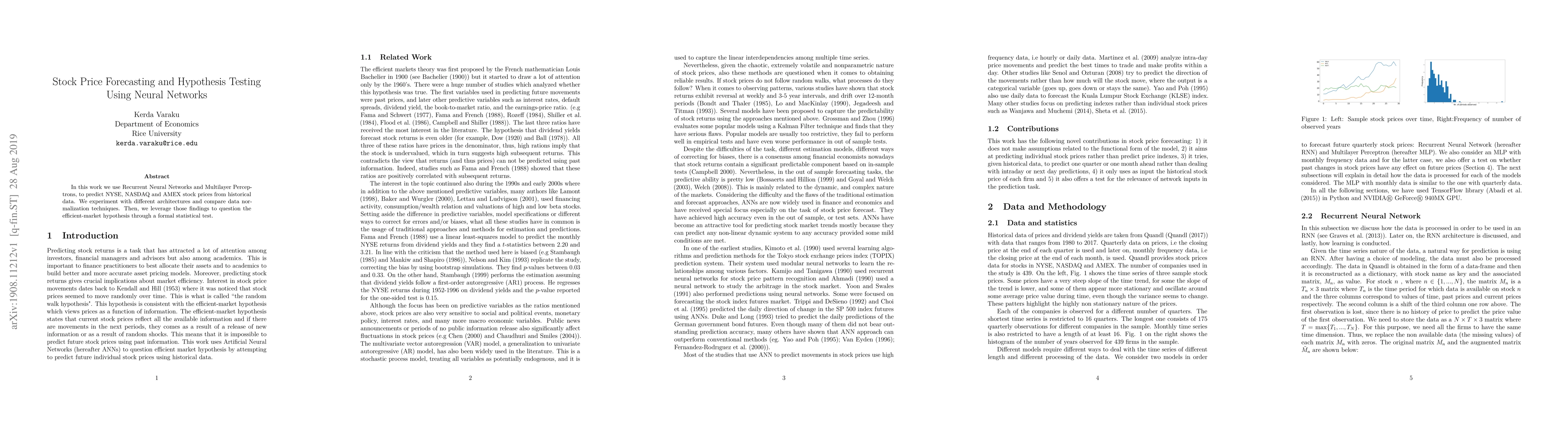

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHidformer: Transformer-Style Neural Network in Stock Price Forecasting

Kamil Ł. Szydłowski, Jarosław A. Chudziak

| Title | Authors | Year | Actions |

|---|

Comments (0)