Summary

The study of systemic risk is often presented through the analysis of several measures referring to quantities used by practitioners and policy makers. Almost invariably, those measures evaluate the size of the impact that exogenous events can exhibit on a financial system without analysing the nature of initial shock. Here we present a symmetric approach and propose a set of measures that are based on the amount of exogenous shock that can be absorbed by the system before it starts to deteriorate. For this purpose, we use a linearized version of DebtRank that allows to clearly show the onset of financial distress towards a correct systemic risk estimation. We show how we can explicitly compute localized and uniform exogenous shocks and explained their behavior though spectral graph theory. We also extend analysis to heterogeneous shocks that have to be computed by means of Monte Carlo simulations. We believe that our approach is more general and natural and allows to express in a standard way the failure risk in financial systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

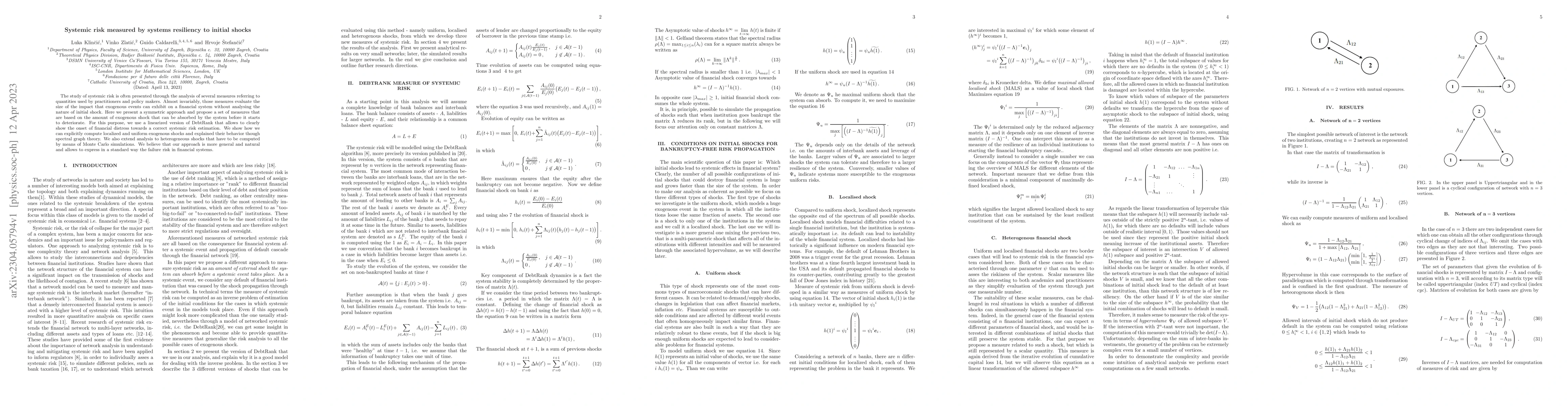

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)