Summary

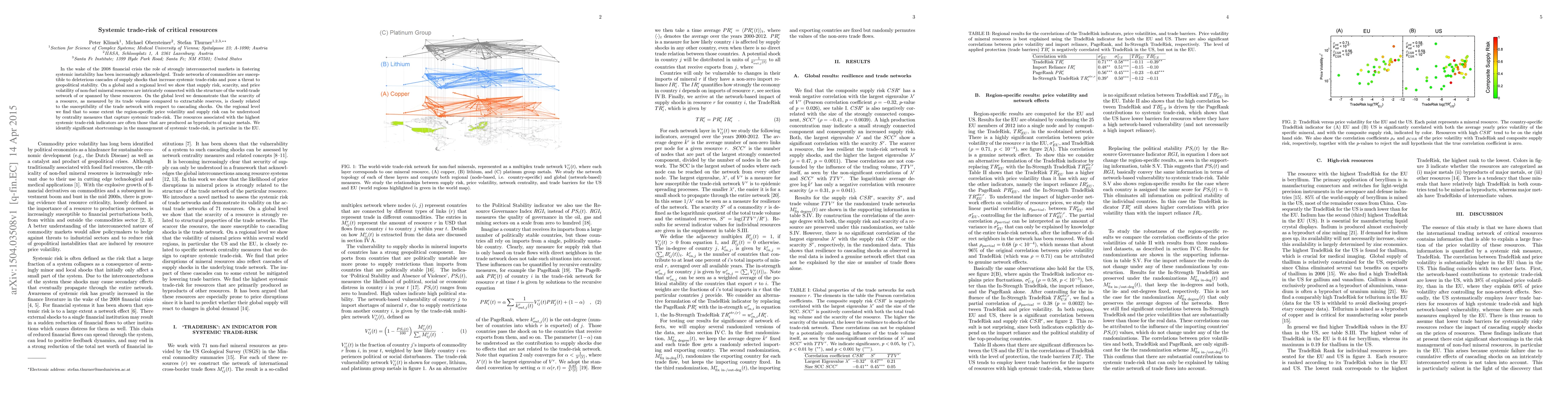

In the wake of the 2008 financial crisis the role of strongly interconnected markets in fostering systemic instability has been increasingly acknowledged. Trade networks of commodities are susceptible to deleterious cascades of supply shocks that increase systemic trade-risks and pose a threat to geopolitical stability. On a global and a regional level we show that supply risk, scarcity, and price volatility of non-fuel mineral resources are intricately connected with the structure of the world-trade network of or spanned by these resources. On the global level we demonstrate that the scarcity of a resource, as measured by its trade volume compared to extractable reserves, is closely related to the susceptibility of the trade network with respect to cascading shocks. On the regional level we find that to some extent the region-specific price volatility and supply risk can be understood by centrality measures that capture systemic trade-risk. The resources associated with the highest systemic trade-risk indicators are often those that are produced as byproducts of major metals. We identify significant shortcomings in the management of systemic trade-risk, in particular in the EU.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSystemic Trade Risk Suppresses Comparative Advantage in Rare Earth Dependent Industries

Peter Klimek, Maximilian Hess, Markus Gerschberger et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)