Authors

Summary

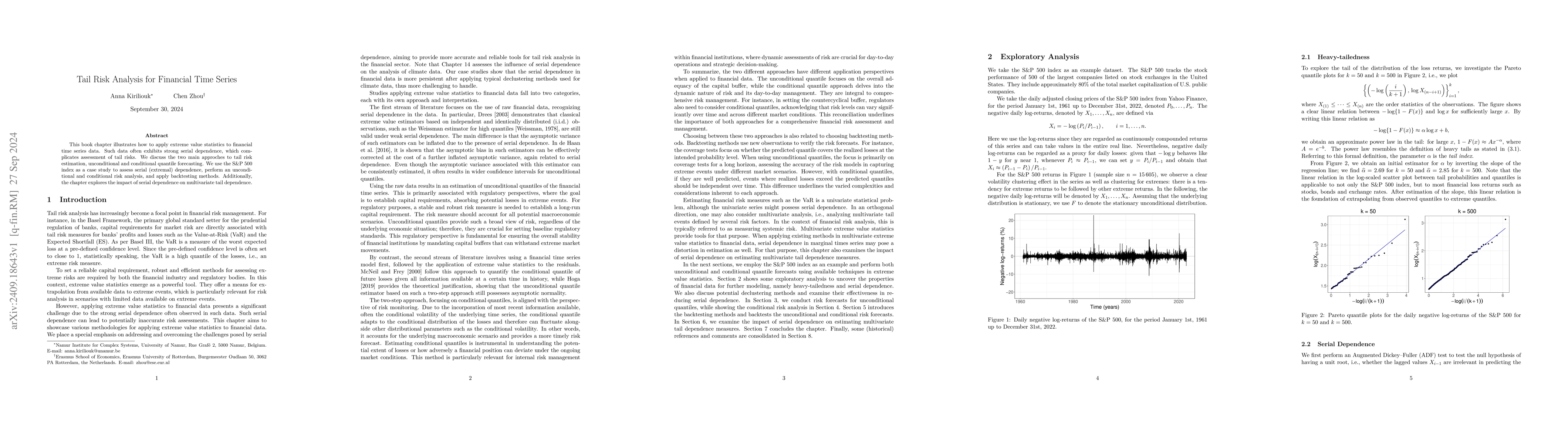

This book chapter illustrates how to apply extreme value statistics to financial time series data. Such data often exhibits strong serial dependence, which complicates assessment of tail risks. We discuss the two main approches to tail risk estimation, unconditional and conditional quantile forecasting. We use the S&P 500 index as a case study to assess serial (extremal) dependence, perform an unconditional and conditional risk analysis, and apply backtesting methods. Additionally, the chapter explores the impact of serial dependence on multivariate tail dependence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)