Summary

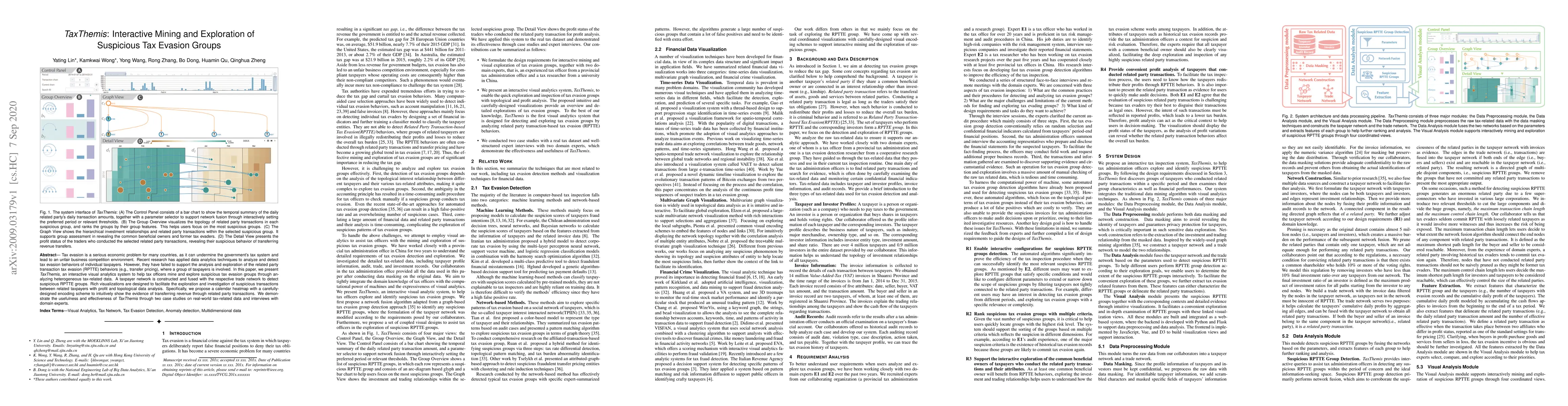

Tax evasion is a serious economic problem for many countries, as it can undermine the government' s tax system and lead to an unfair business competition environment. Recent research has applied data analytics techniques to analyze and detect tax evasion behaviors of individual taxpayers. However, they failed to support the analysis and exploration of the uprising related party transaction tax evasion (RPTTE) behaviors (e.g., transfer pricing), where a group of taxpayers is involved. In this paper, we present TaxThemis, an interactive visual analytics system to help tax officers mine and explore suspicious tax evasion groups through analyzing heterogeneous tax-related data. A taxpayer network is constructed and fused with the trade network to detect suspicious RPTTE groups. Rich visualizations are designed to facilitate the exploration and investigation of suspicious transactions between related taxpayers with profit and topological data analysis. Specifically, we propose a calendar heatmap with a carefully-designed encoding scheme to intuitively show the evidence of transferring revenue through related party transactions. We demonstrate the usefulness and effectiveness of TaxThemis through two case studies on real-world tax-related data, and interviews with domain experts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA dynamic model of Tax Evasion

Alessandro Pluchino, Giulio Burgio, Alessio Emanuele Biondo et al.

Identifying tax evasion in Mexico with tools from network science and machine learning

Carlos Pineda, Carlos Gershenson, Gerardo Iñiguez et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)