Summary

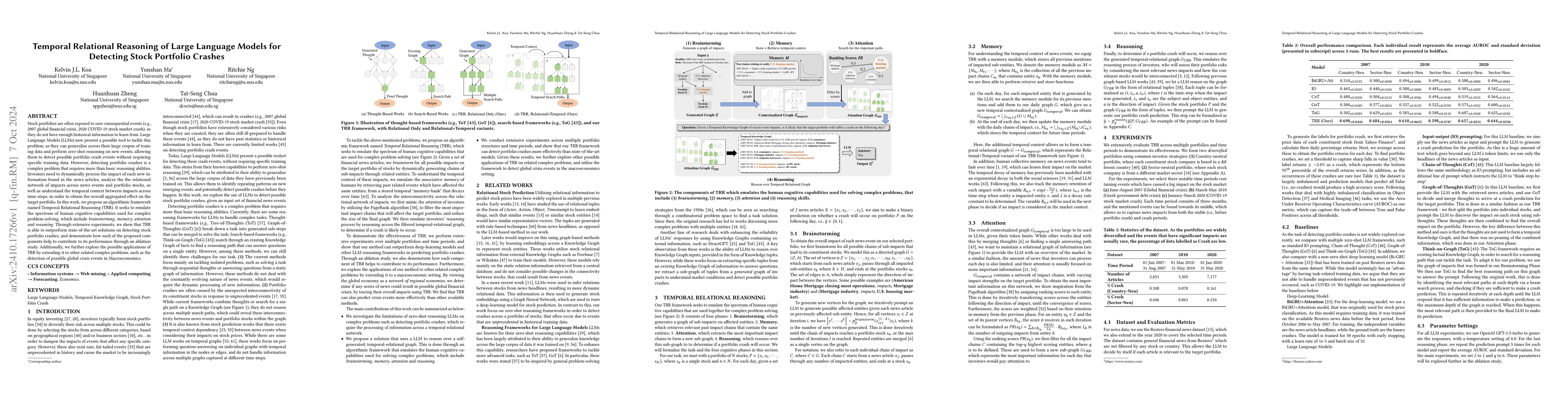

Stock portfolios are often exposed to rare consequential events (e.g., 2007 global financial crisis, 2020 COVID-19 stock market crash), as they do not have enough historical information to learn from. Large Language Models (LLMs) now present a possible tool to tackle this problem, as they can generalize across their large corpus of training data and perform zero-shot reasoning on new events, allowing them to detect possible portfolio crash events without requiring specific training data. However, detecting portfolio crashes is a complex problem that requires more than basic reasoning abilities. Investors need to dynamically process the impact of each new information found in the news articles, analyze the the relational network of impacts across news events and portfolio stocks, as well as understand the temporal context between impacts across time-steps, in order to obtain the overall aggregated effect on the target portfolio. In this work, we propose an algorithmic framework named Temporal Relational Reasoning (TRR). It seeks to emulate the spectrum of human cognitive capabilities used for complex problem-solving, which include brainstorming, memory, attention and reasoning. Through extensive experiments, we show that TRR is able to outperform state-of-the-art solutions on detecting stock portfolio crashes, and demonstrate how each of the proposed components help to contribute to its performance through an ablation study. Additionally, we further explore the possible applications of TRR by extending it to other related complex problems, such as the detection of possible global crisis events in Macroeconomics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRelational Temporal Graph Reasoning for Dual-task Dialogue Language Understanding

Bowen Xing, Ivor W. Tsang

Benchmarking Systematic Relational Reasoning with Large Language and Reasoning Models

Irtaza Khalid, Steven Schockaert, Amir Masoud Nourollah

TRAM: Benchmarking Temporal Reasoning for Large Language Models

Yun Zhao, Yuqing Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)