Authors

Summary

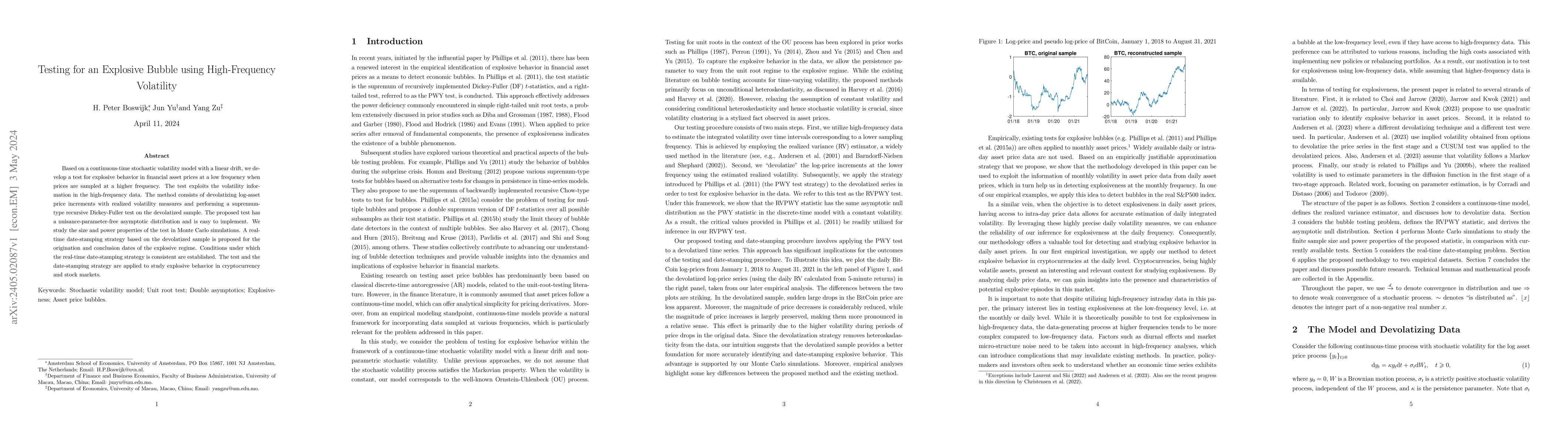

Based on a continuous-time stochastic volatility model with a linear drift, we develop a test for explosive behavior in financial asset prices at a low frequency when prices are sampled at a higher frequency. The test exploits the volatility information in the high-frequency data. The method consists of devolatizing log-asset price increments with realized volatility measures and performing a supremum-type recursive Dickey-Fuller test on the devolatized sample. The proposed test has a nuisance-parameter-free asymptotic distribution and is easy to implement. We study the size and power properties of the test in Monte Carlo simulations. A real-time date-stamping strategy based on the devolatized sample is proposed for the origination and conclusion dates of the explosive regime. Conditions under which the real-time date-stamping strategy is consistent are established. The test and the date-stamping strategy are applied to study explosive behavior in cryptocurrency and stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)