Authors

Summary

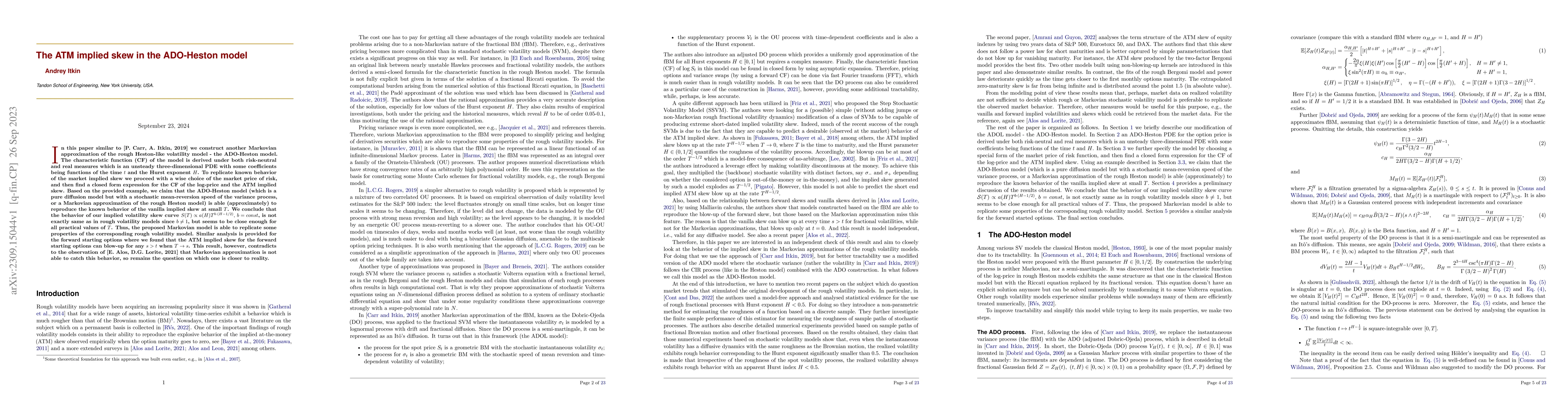

In this paper similar to [P. Carr, A. Itkin, 2019] we construct another Markovian approximation of the rough Heston-like volatility model - the ADO-Heston model. The characteristic function (CF) of the model is derived under both risk-neutral and real measures which is an unsteady three-dimensional PDE with some coefficients being functions of the time $t$ and the Hurst exponent $H$. To replicate known behavior of the market implied skew we proceed with a wise choice of the market price of risk, and then find a closed form expression for the CF of the log-price and the ATM implied skew. Based on the provided example, we claim that the ADO-Heston model (which is a pure diffusion model but with a stochastic mean-reversion speed of the variance process, or a Markovian approximation of the rough Heston model) is able (approximately) to reproduce the known behavior of the vanilla implied skew at small $T$. We conclude that the behavior of our implied volatility skew curve ${\cal S}(T) \propto a(H) T^{b\cdot (H-1/2)}, \, b = const$, is not exactly same as in rough volatility models since $b \ne 1$, but seems to be close enough for all practical values of $T$. Thus, the proposed Markovian model is able to replicate some properties of the corresponding rough volatility model. Similar analysis is provided for the forward starting options where we found that the ATM implied skew for the forward starting options can blow-up for any $s > t$ when $T \to s$. This result, however, contradicts to the observation of [E. Alos, D.G. Lorite, 2021] that Markovian approximation is not able to catch this behavior, so remains the question on which one is closer to reality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)