Summary

We establish new results for estimation and inference in financial durations models, where events are observed over a given time span, such as a trading day, or a week. For the classical autoregressive conditional duration (ACD) models by Engle and Russell (1998, Econometrica 66, 1127-1162), we show that the large sample behavior of likelihood estimators is highly sensitive to the tail behavior of the financial durations. In particular, even under stationarity, asymptotic normality breaks down for tail indices smaller than one or, equivalently, when the clustering behaviour of the observed events is such that the unconditional distribution of the durations has no finite mean. Instead, we find that estimators are mixed Gaussian and have non-standard rates of convergence. The results are based on exploiting the crucial fact that for duration data the number of observations within any given time span is random. Our results apply to general econometric models where the number of observed events is random.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

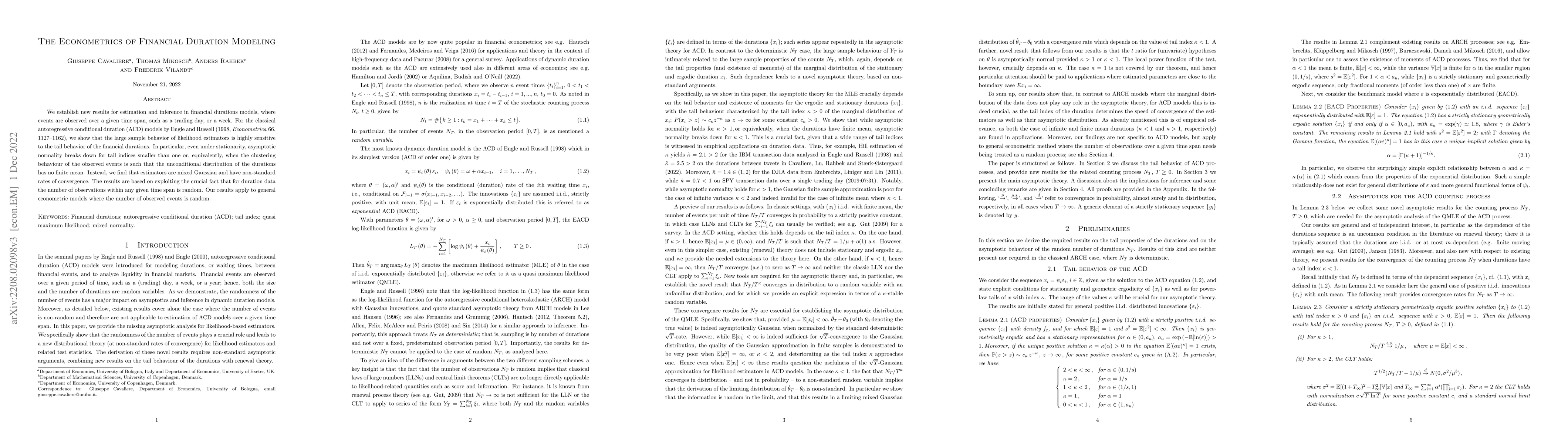

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBivariate autoregressive conditional models: A new method for jointly modeling duration and number of transactions of irregularly spaced financial data

Roberto Vila, Helton Saulo, Suvra Pal

| Title | Authors | Year | Actions |

|---|

Comments (0)