Summary

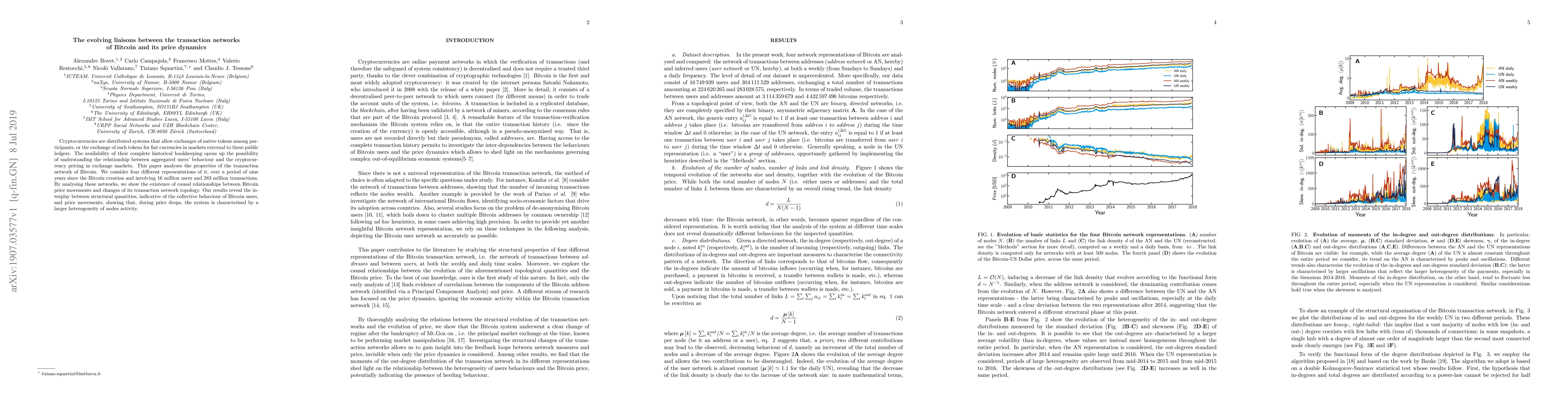

Cryptocurrencies are distributed systems that allow exchanges of native tokens among participants, or the exchange of such tokens for fiat currencies in markets external to these public ledgers. The availability of their complete historical bookkeeping opens up the possibility of understanding the relationship between aggregated users' behaviour and the cryptocurrency pricing in exchange markets. This paper analyses the properties of the transaction network of Bitcoin. We consider four different representations of it, over a period of nine years since the Bitcoin creation and involving 16 million users and 283 million transactions. By analysing these networks, we show the existence of causal relationships between Bitcoin price movements and changes of its transaction network topology. Our results reveal the interplay between structural quantities, indicative of the collective behaviour of Bitcoin users, and price movements, showing that, during price drops, the system is characterised by a larger heterogeneity of nodes activity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)