Authors

Summary

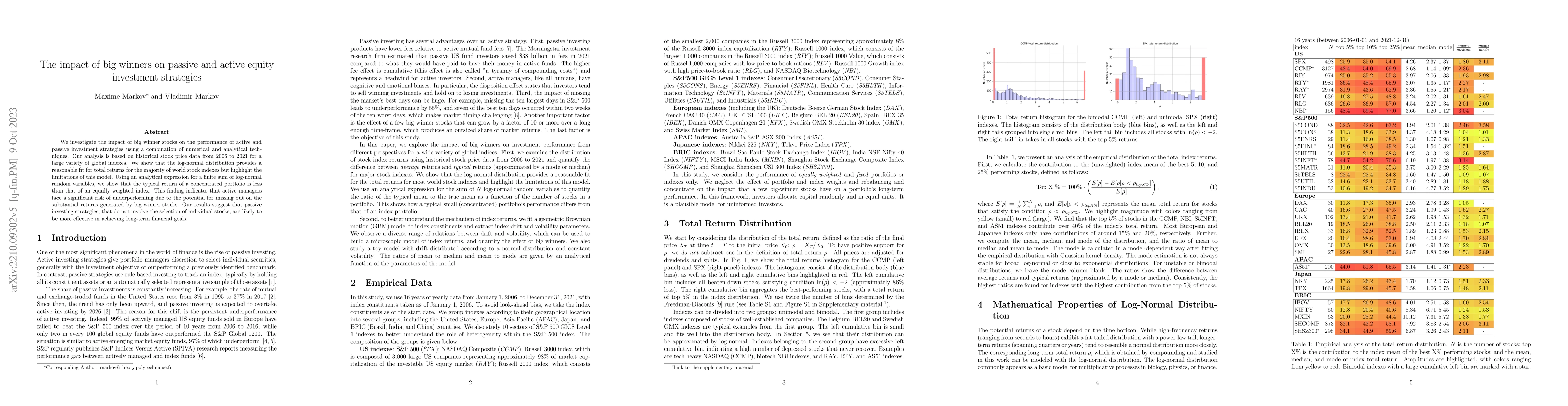

We investigate the impact of big winner stocks on the performance of active and passive investment strategies using a combination of numerical and analytical techniques. Our analysis is based on historical stock price data from 2006 to 2021 for a large variety of global indexes. We show that the log-normal distribution provides a reasonable fit for total returns for the majority of world stock indexes but highlight the limitations of this model. Using an analytical expression for a finite sum of log-normal random variables, we show that the typical return of a concentrated portfolio is less than that of an equally weighted index. This finding indicates that active managers face a significant risk of underperforming due to the potential for missing out on the substantial returns generated by big winner stocks. Our results suggest that passive investing strategies, that do not involve the selection of individual stocks, are likely to be more effective in achieving long-term financial goals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPassive learning of active causal strategies in agents and language models

Andrew Kyle Lampinen, Ishita Dasgupta, Stephanie C Y Chan et al.

Hedging Properties of Algorithmic Investment Strategies using Long Short-Term Memory and Time Series models for Equity Indices

Robert Ślepaczuk, Jakub Michańków, Paweł Sakowski

| Title | Authors | Year | Actions |

|---|

Comments (0)