Authors

Summary

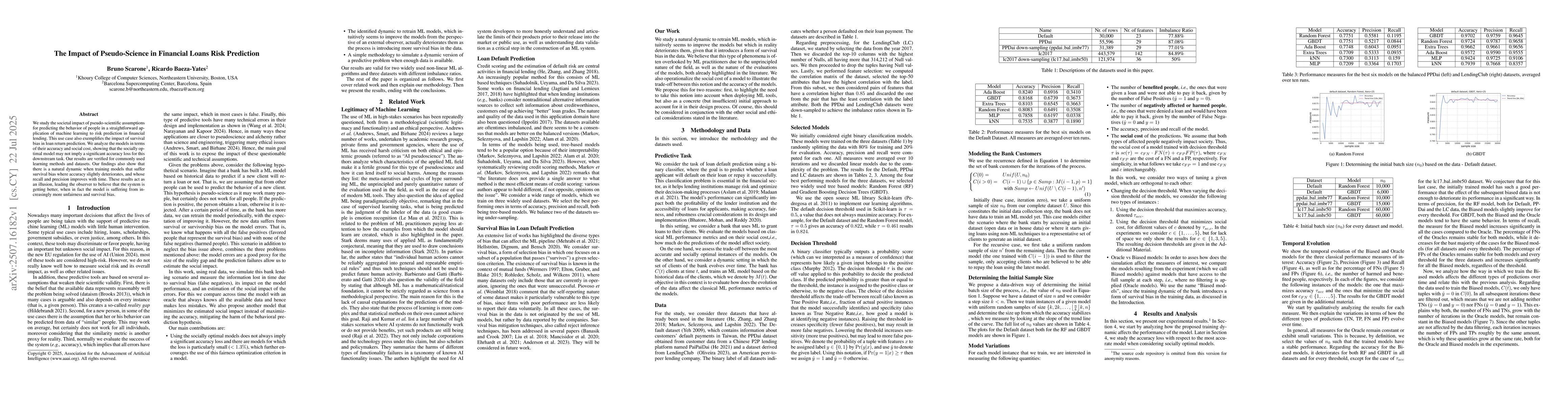

We study the societal impact of pseudo-scientific assumptions for predicting the behavior of people in a straightforward application of machine learning to risk prediction in financial lending. This use case also exemplifies the impact of survival bias in loan return prediction. We analyze the models in terms of their accuracy and social cost, showing that the socially optimal model may not imply a significant accuracy loss for this downstream task. Our results are verified for commonly used learning methods and datasets. Our findings also show that there is a natural dynamic when training models that suffer survival bias where accuracy slightly deteriorates, and whose recall and precision improves with time. These results act as an illusion, leading the observer to believe that the system is getting better, when in fact the model is suffering from increasingly more unfairness and survival bias.

AI Key Findings

Generated Jul 24, 2025

Methodology

The research analyzes the impact of pseudo-scientific assumptions in machine learning models for financial loan risk prediction, focusing on accuracy and social cost. It examines commonly used learning methods and datasets, identifying a dynamic where accuracy slightly deteriorates over time, while recall and precision improve, creating an illusion of system improvement due to increasing unfairness and survival bias.

Key Results

- Socially optimal models may not imply significant accuracy loss for loan risk prediction tasks.

- Models suffering from survival bias exhibit a temporal pattern where accuracy degrades, precision improves, and recall increases, misleading observers into believing the system is improving.

- For the balanced LC dataset, the accuracy loss for socially optimal models is particularly small, even with high cFN impact, making it encouraging to use this optimization criterion in model training.

- The study presents competitive models for risk prediction in different bank lending datasets.

- The simulation methodology used in this paper can be applied to many cases where sufficient data is available.

Significance

This research emphasizes the importance of legitimacy and competence in predictive machine learning applications related to human behavior, highlighting the harmful societal impacts of pseudoscience, technical mistakes, and incorrect evaluation methods.

Technical Contribution

The paper presents a comprehensive analysis of the trade-off between most accurate and socially optimal models, demonstrating that the accuracy loss for socially optimal models is minimal, especially for balanced datasets.

Novelty

This work distinguishes itself by focusing on the societal impact of pseudo-scientific assumptions in financial loan risk prediction, providing a detailed examination of survival bias and its effects on model performance over time.

Limitations

- The study focuses on loan risk prediction, so its findings may not generalize to other predictive ML applications.

- The research does not explore the long-term consequences of deploying biased models in real-world financial systems.

Future Work

- Further improve feature selection in the models.

- Find analytic expressions for different types of predictions to conduct a more in-depth study.

- Mitigate survival bias to verify how results extend to more complex cases.

- Apply the same methodology to study well-known AI incidents from the perspective of pseudo-science and/or bias.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Convergence of Credit Risk in Current Consumer Automobile Loans

Jun Yan, Jackson P. Lautier, Vladimir Pozdnyakov

No citations found for this paper.

Comments (0)