Summary

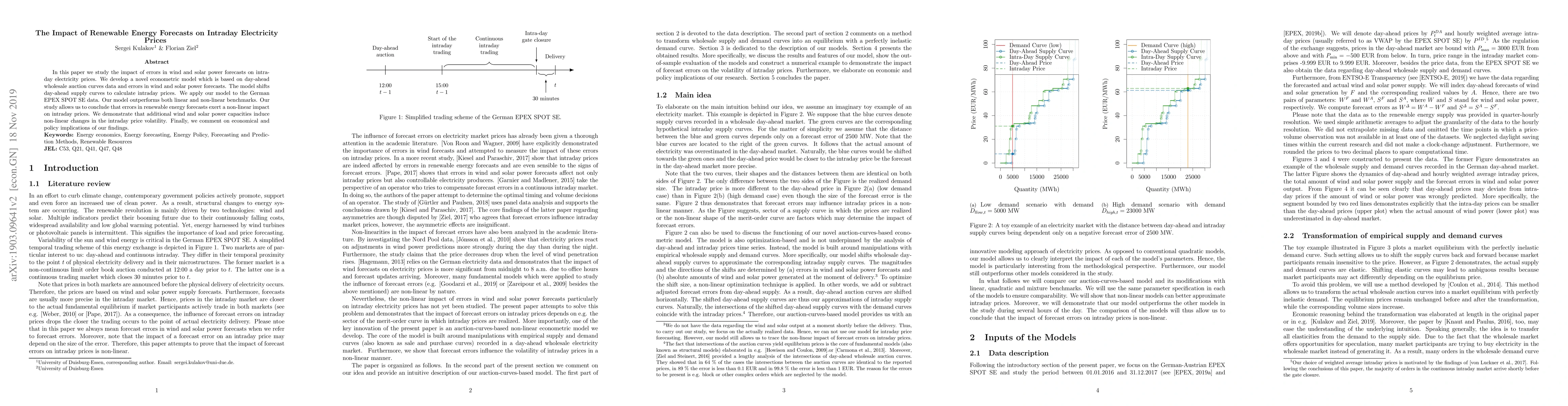

In this paper we study the impact of errors in wind and solar power forecasts on intraday electricity prices. We develop a novel econometric model which is based on day-ahead wholesale auction curves data and errors in wind and solar power forecasts. The model shifts day-ahead supply curves to calculate intraday prices. We apply our model to the German EPEX SPOT SE data. Our model outperforms both linear and non-linear benchmarks. Our study allows us to conclude that errors in renewable energy forecasts exert a non-linear impact on intraday prices. We demonstrate that additional wind and solar power capacities induce non-linear changes in the intraday price volatility. Finally, we comment on economical and policy implications of our findings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Hierarchical Probabilistic Forecasting of Intraday Electricity Prices

Daniel Nickelsen, Gernot Müller

A Multivariate Dependence Analysis for Electricity Prices, Demand and Renewable Energy Sources

Luca Rossini, Fabrizio Durante, Francesco Ravazzolo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)