Authors

Summary

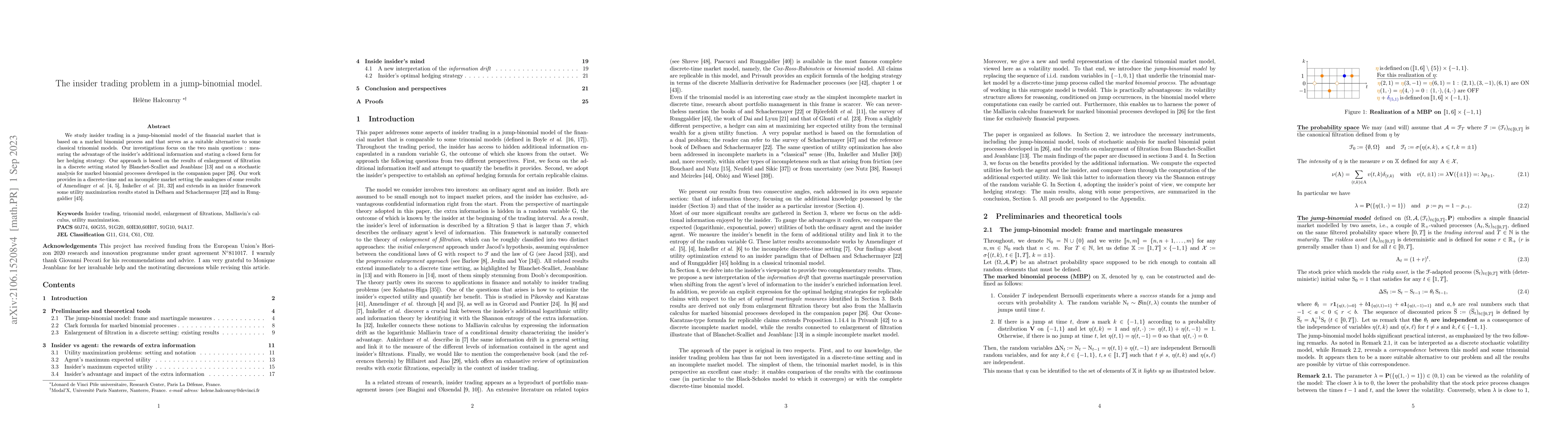

In an incomplete market underpinned by the trinomial model, we consider two investors : an ordinary agent whose decisions are driven by public information and an insider who possesses from the beginning a surplus of information encoded through a random variable for which he or she knows the outcome. Through the definition of an auxiliary model based on a marked binomial process, we handle the trinomial model as a volatility one, and use the stochastic analysis and Malliavin calculus toolboxes available in that context. In particular, we connect the information drift, the drift to eliminate in order to preserve the martingale property within an initial enlargement of filtration in terms of the Malliavin derivative. We solve explicitly the agent and the insider expected logarithmic utility maximisation problems and provide a hedging formula for replicable claims. We identify the insider expected additional utility with the Shannon entropy of the extra information, and examine then the existence of arbitrage opportunities for the insider.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA New Approach for the Continuous Time Kyle-Back Strategic Insider Equilibrium Problem

Jianfeng Zhang, Bixing Qiao

| Title | Authors | Year | Actions |

|---|

Comments (0)