Summary

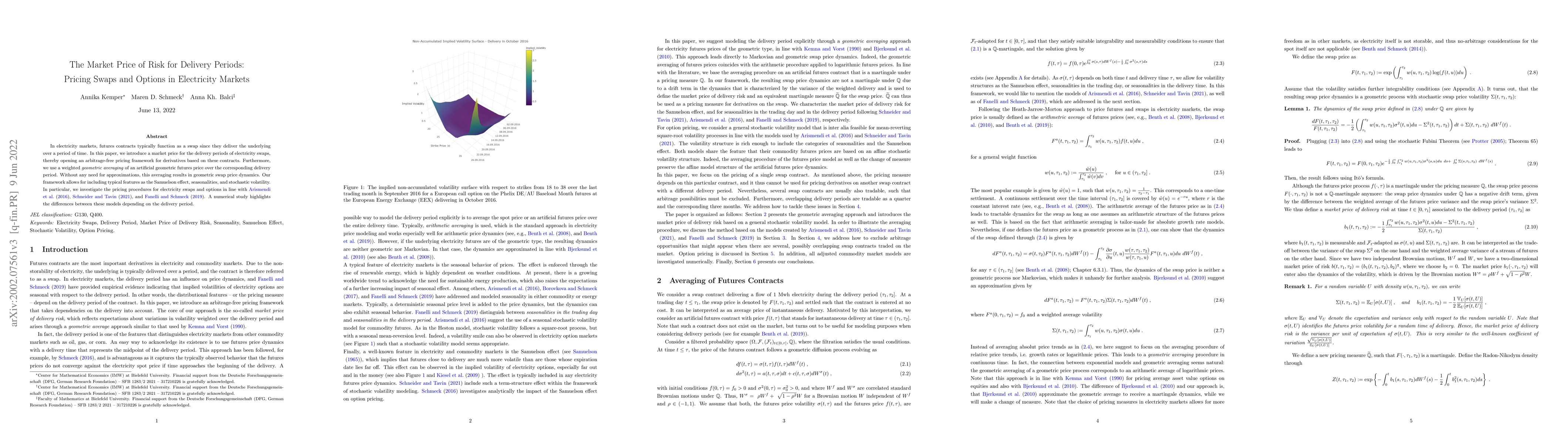

In electricity markets, futures contracts typically function as a swap since they deliver the underlying over a period of time. In this paper, we introduce a market price for the delivery periods of electricity swaps, thereby opening an arbitrage-free pricing framework for derivatives based on these contracts. Furthermore, we use a weighted geometric averaging of an artificial geometric futures price over the corresponding delivery period. Without any need for approximations, this averaging results in geometric swap price dynamics. Our framework allows for including typical features as the Samuelson effect, seasonalities, and stochastic volatility. In particular, we investigate the pricing procedures for electricity swaps and options in line with Arismendi et al. (2016), Schneider and Tavin (2018), and Fanelli and Schmeck (2019). A numerical study highlights the differences between these models depending on the delivery period.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Market Price of Jump Risk for Delivery Periods: Pricing of Electricity Swaps with Geometric Averaging

Annika Kemper, Maren Diane Schmeck

Price-Aware Deep Learning for Electricity Markets

Vladimir Dvorkin, Ferdinando Fioretto

| Title | Authors | Year | Actions |

|---|

Comments (0)