Authors

Summary

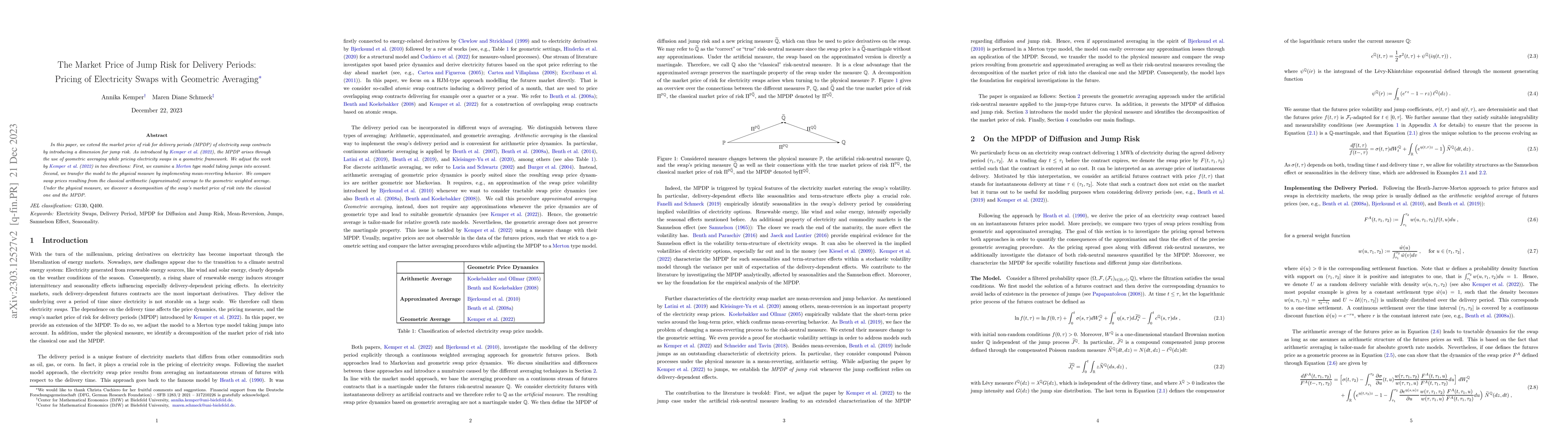

In this paper, we extend the market price of risk for delivery periods (MPDP) of electricity swap contracts by introducing a dimension for jump risk. As introduced by Kemper et al. (2022), the MPDP arises through the use of geometric averaging while pricing electricity swaps in a geometric framework. We adjust the work by Kemper et al. (2022) in two directions: First, we examine a Merton type model taking jumps into account. Second, we transfer the model to the physical measure by implementing mean-reverting behavior. We compare swap prices resulting from the classical arithmetic (approximated) average to the geometric weighted average. Under the physical measure, we discover a decomposition of the swap's market price of risk into the classical one and the MPDP.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Market Price of Risk for Delivery Periods: Pricing Swaps and Options in Electricity Markets

Anna Kh. Balci, Annika Kemper, Maren D. Schmeck

A Comparative Study of Factor Models for Different Periods of the Electricity Spot Price Market

Christian Laudagé, Florian Aichinger, Sascha Desmettre

Pricing Transition Risk with a Jump-Diffusion Credit Risk Model: Evidences from the CDS market

Giulia Livieri, Davide Radi, Elia Smaniotto

No citations found for this paper.

Comments (0)