Authors

Summary

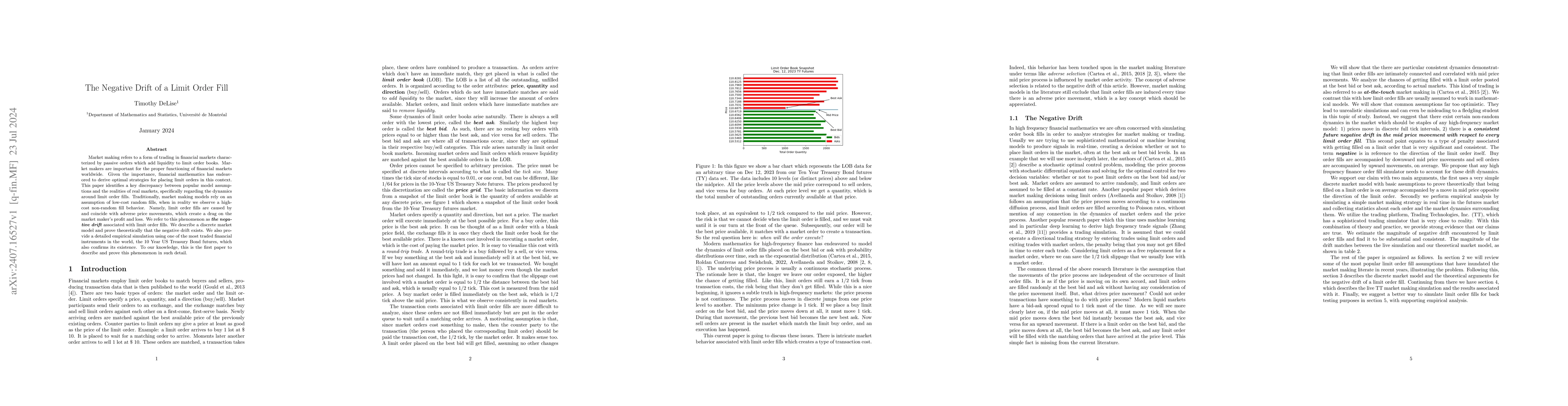

Market making refers to a form of trading in financial markets characterized by passive orders which add liquidity to limit order books. Market makers are important for the proper functioning of financial markets worldwide. Given the importance, financial mathematics has endeavored to derive optimal strategies for placing limit orders in this context. This paper identifies a key discrepancy between popular model assumptions and the realities of real markets, specifically regarding the dynamics around limit order fills. Traditionally, market making models rely on an assumption of low-cost random fills, when in reality we observe a high-cost non-random fill behavior. Namely, limit order fills are caused by and coincide with adverse price movements, which create a drag on the market maker's profit and loss. We refer to this phenomenon as "the negative drift" associated with limit order fills. We describe a discrete market model and prove theoretically that the negative drift exists. We also provide a detailed empirical simulation using one of the most traded financial instruments in the world, the 10 Year US Treasury Bond futures, which also confirms its existence. To our knowledge, this is the first paper to describe and prove this phenomenon in such detail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFill Probabilities in a Limit Order Book with State-Dependent Stochastic Order Flows

Felix Lokin, Fenghui Yu

Deep Attentive Survival Analysis in Limit Order Books: Estimating Fill Probabilities with Convolutional-Transformers

Stefan Zohren, Fernando Moreno-Pino, Alvaro Arroyo et al.

Rigidity of spin fill-ins with non-negative scalar curvature

Simone Cecchini, Rudolf Zeidler, Sven Hirsch

| Title | Authors | Year | Actions |

|---|

Comments (0)