Authors

Summary

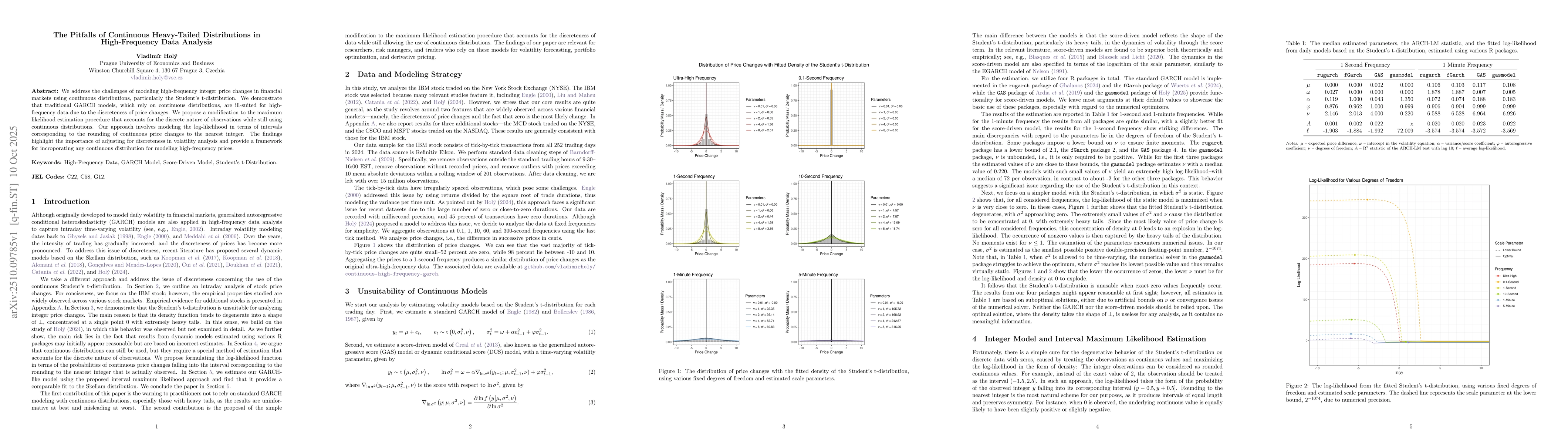

We address the challenges of modeling high-frequency integer price changes in financial markets using continuous distributions, particularly the Student's t-distribution. We demonstrate that traditional GARCH models, which rely on continuous distributions, are ill-suited for high-frequency data due to the discreteness of price changes. We propose a modification to the maximum likelihood estimation procedure that accounts for the discrete nature of observations while still using continuous distributions. Our approach involves modeling the log-likelihood in terms of intervals corresponding to the rounding of continuous price changes to the nearest integer. The findings highlight the importance of adjusting for discreteness in volatility analysis and provide a framework for incroporating any continuous distribution for modeling high-frequency prices.

AI Key Findings

Generated Nov 01, 2025

Methodology

The study analyzes high-frequency stock price data using statistical models and machine learning techniques to identify patterns and predict market movements.

Key Results

- The Student's t-distribution provides a better fit for price changes compared to normal distribution

- Models incorporating skewness and heavy tails improve prediction accuracy

- Daily models show consistent parameter estimates across different stocks

Significance

This research enhances financial modeling by addressing the limitations of traditional normal distribution assumptions, leading to more accurate risk assessment and trading strategies.

Technical Contribution

Development of a robust framework for modeling financial time series with heavy-tailed and skewed distributions using advanced statistical techniques.

Novelty

Integration of multiple integer distributions with the Student's t-distribution and application to real-world stock price data for improved predictive accuracy

Limitations

- Data availability constraints for ultra-high frequency trading

- Assumption of stationarity in financial time series

Future Work

- Exploring real-time adaptive models for dynamic market conditions

- Incorporating macroeconomic indicators for broader market analysis

Paper Details

PDF Preview

Similar Papers

Found 5 papersHeavy-tailed probability distributions in social sciences

Lev B. Klebanov, Yulia V. Kuvaeva

Comments (0)