Summary

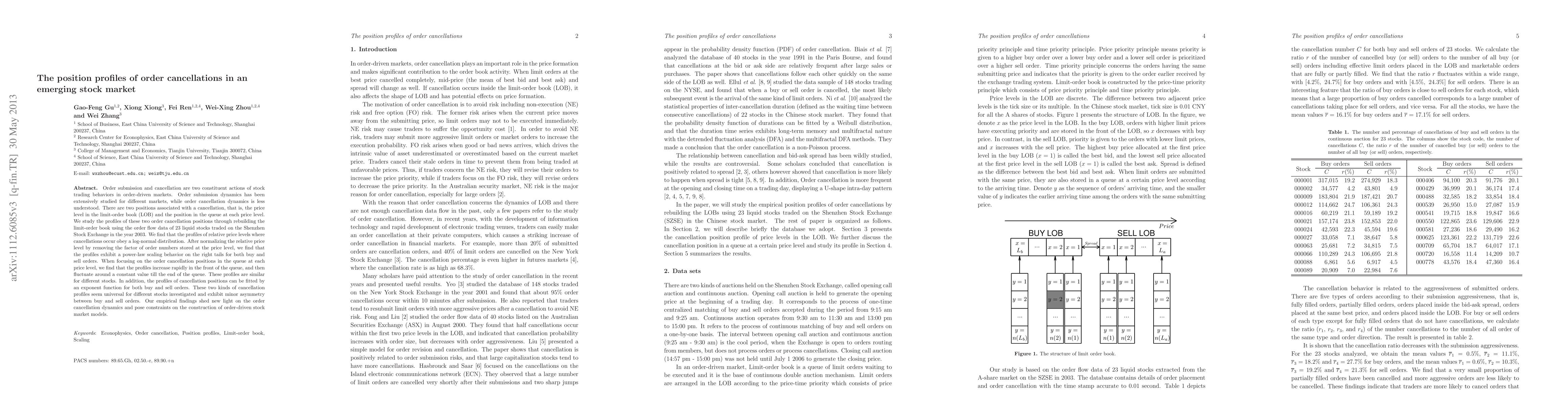

Order submission and cancellation are two constituent actions of stock trading behaviors in order-driven markets. Order submission dynamics has been extensively studied for different markets, while order cancellation dynamics is less understood. There are two positions associated with a cancellation, that is, the price level in the limit-order book (LOB) and the position in the queue at each price level. We study the profiles of these two order cancellation positions through rebuilding the limit-order book using the order flow data of 23 liquid stocks traded on the Shenzhen Stock Exchange in the year 2003. We find that the profiles of relative price levels where cancellations occur obey a log-normal distribution. After normalizing the relative price level by removing the factor of order numbers stored at the price level, we find that the profiles exhibit a power-law scaling behavior on the right tails for both buy and sell orders. When focusing on the order cancellation positions in the queue at each price level, we find that the profiles increase rapidly in the front of the queue, and then fluctuate around a constant value till the end of the queue. These profiles are similar for different stocks. In addition, the profiles of cancellation positions can be fitted by an exponent function for both buy and sell orders. These two kinds of cancellation profiles seem universal for different stocks investigated and exhibit minor asymmetry between buy and sell orders. Our empirical findings shed new light on the order cancellation dynamics and pose constraints on the construction of order-driven stock market models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)