Authors

Summary

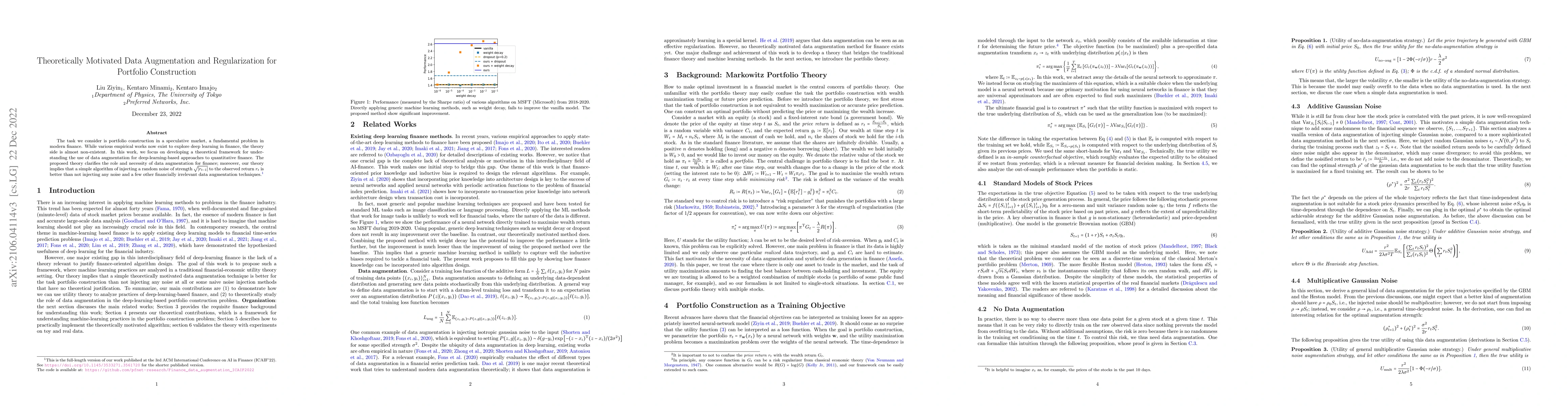

The task we consider is portfolio construction in a speculative market, a fundamental problem in modern finance. While various empirical works now exist to explore deep learning in finance, the theory side is almost non-existent. In this work, we focus on developing a theoretical framework for understanding the use of data augmentation for deep-learning-based approaches to quantitative finance. The proposed theory clarifies the role and necessity of data augmentation for finance; moreover, our theory implies that a simple algorithm of injecting a random noise of strength $\sqrt{|r_{t-1}|}$ to the observed return $r_{t}$ is better than not injecting any noise and a few other financially irrelevant data augmentation techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIs linguistically-motivated data augmentation worth it?

Michael Ginn, Alexis Palmer, Ray Groshan

Data Augmentation and Regularization for Learning Group Equivariance

Axel Flinth, Oskar Nordenfors

Toward Learning Robust and Invariant Representations with Alignment Regularization and Data Augmentation

Haohan Wang, Eric P. Xing, Xindi Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)