Summary

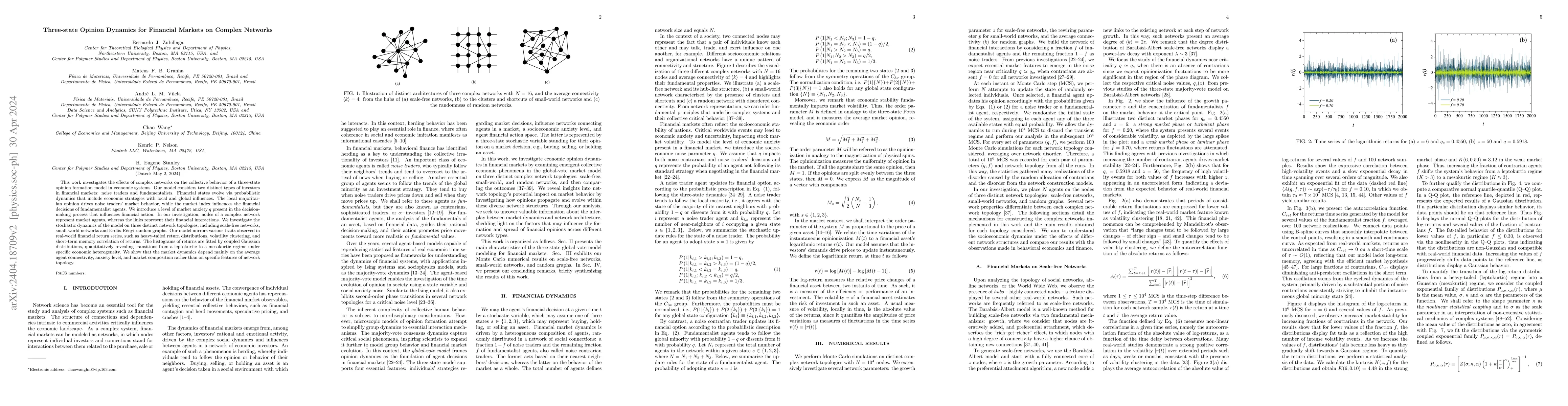

This work investigates the effects of complex networks on the collective behavior of a three-state opinion formation model in economic systems. Our model considers two distinct types of investors in financial markets: noise traders and fundamentalists. Financial states evolve via probabilistic dynamics that include economic strategies with local and global influences. The local majoritarian opinion drives noise traders' market behavior, while the market index influences the financial decisions of fundamentalist agents. We introduce a level of market anxiety $q$ present in the decision-making process that influences financial action. In our investigation, nodes of a complex network represent market agents, whereas the links represent their financial interactions. We investigate the stochastic dynamics of the model on three distinct network topologies, including scale-free networks, small-world networks and Erd{\"o}s-R\'enyi random graphs. Our model mirrors various traits observed in real-world financial return series, such as heavy-tailed return distributions, volatility clustering, and short-term memory correlation of returns. The histograms of returns are fitted by coupled Gaussian distributions, quantitatively revealing transitions from a leptokurtic to a mesokurtic regime under specific economic heterogeneity. We show that the market dynamics depend mainly on the average agent connectivity, anxiety level, and market composition rather than on specific features of network topology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOpinion Dynamics in Financial Markets via Random Networks

Chao Wang, H. Eugene Stanley, Mateus F. B. Granha et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)