Summary

We consider two canonical Bayesian mechanism design settings. In the single-item setting, we prove tight approximation ratio for anonymous pricing: compared with Myerson Auction, it extracts at least $\frac{1}{2.62}$-fraction of revenue; there is a matching lower-bound example. In the unit-demand single-buyer setting, we prove tight approximation ratio between the simplest and optimal deterministic mechanisms: in terms of revenue, uniform pricing admits a $2.62$-approximation of item pricing; we further validate the tightness of this ratio. These results settle two open problems asked in~\cite{H13,CD15,AHNPY15,L17,JLTX18}. As an implication, in the single-item setting: we improve the approximation ratio of the second-price auction with anonymous reserve to $2.62$, which breaks the state-of-the-art upper bound of $e \approx 2.72$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

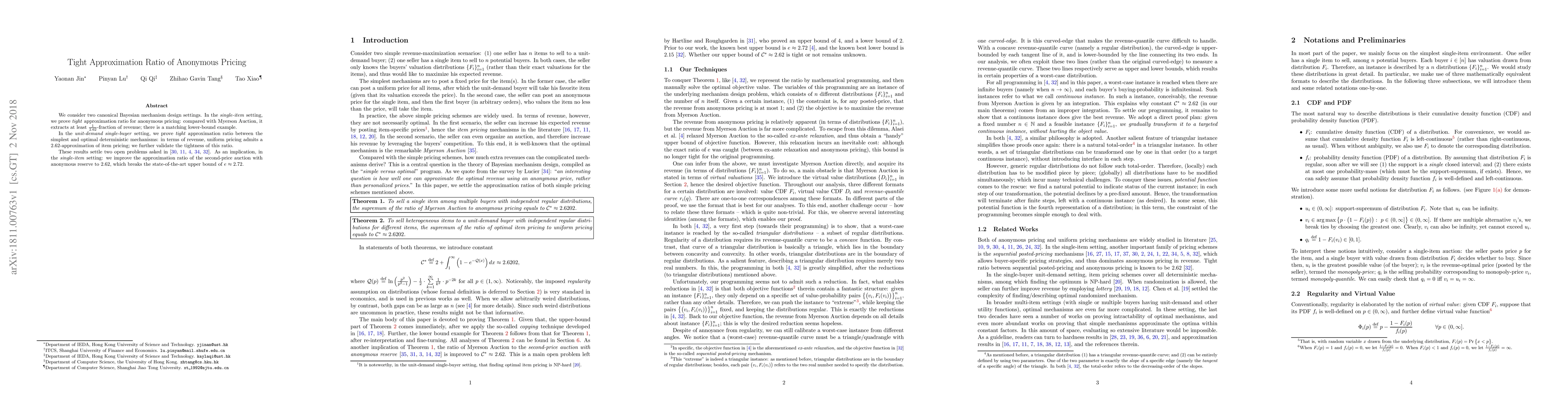

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)