Authors

Summary

We investigate discrete-time mean-variance portfolio selection problems viewed as a Markov decision process. We transform the problems into a new model with deterministic transition function for which the Bellman optimality equation holds. In this way, we can solve the problem recursively and obtain a time-consistent solution, that is an optimal solution that meets the Bellman optimality principle. We apply our technique for solving explicitly a more general framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

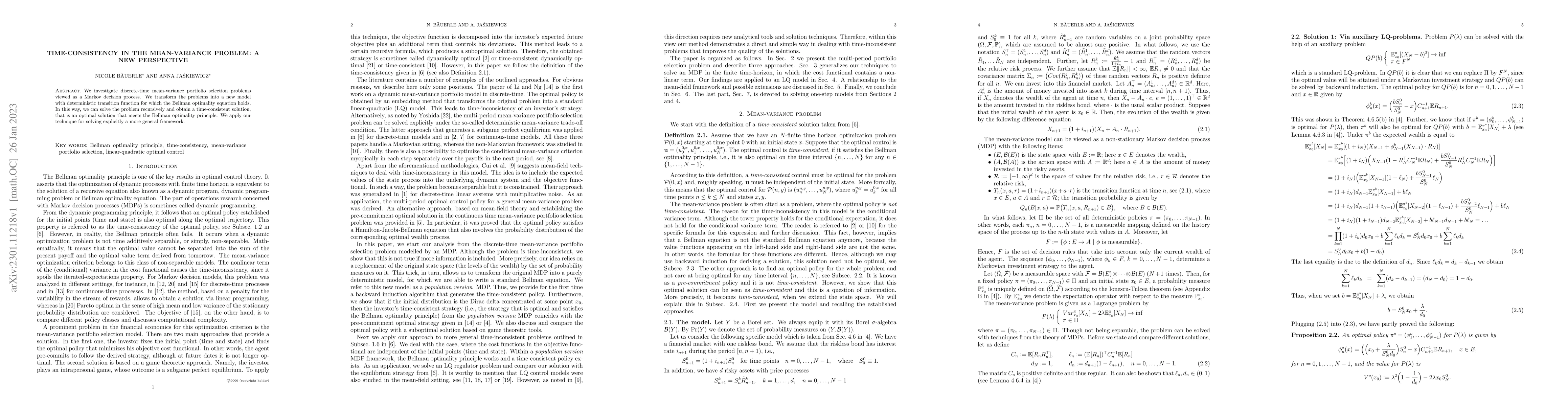

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)