Summary

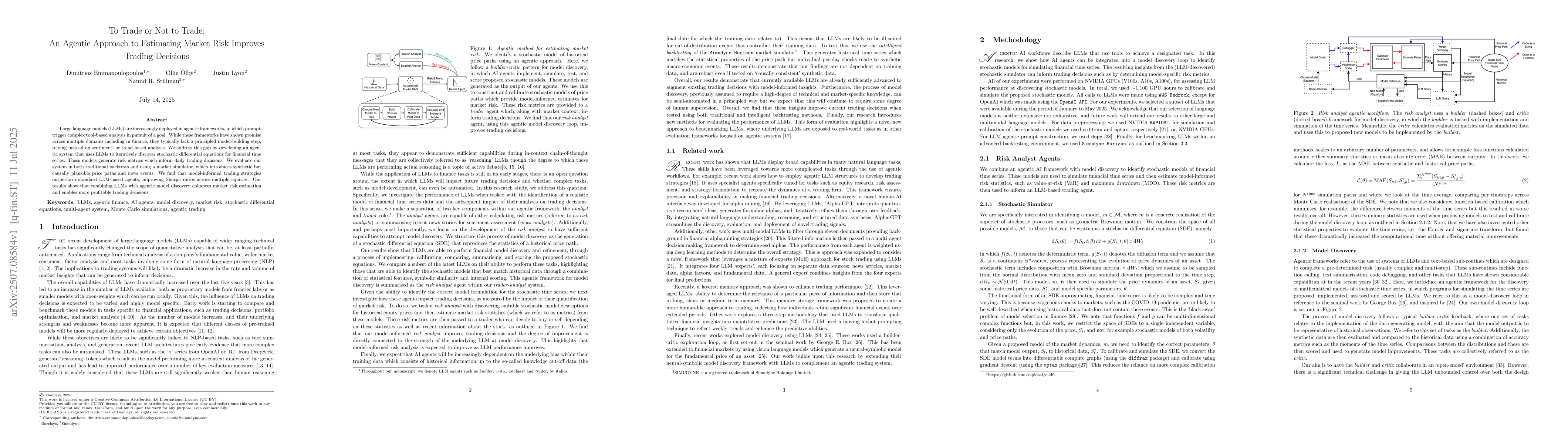

Large language models (LLMs) are increasingly deployed in agentic frameworks, in which prompts trigger complex tool-based analysis in pursuit of a goal. While these frameworks have shown promise across multiple domains including in finance, they typically lack a principled model-building step, relying instead on sentiment- or trend-based analysis. We address this gap by developing an agentic system that uses LLMs to iteratively discover stochastic differential equations for financial time series. These models generate risk metrics which inform daily trading decisions. We evaluate our system in both traditional backtests and using a market simulator, which introduces synthetic but causally plausible price paths and news events. We find that model-informed trading strategies outperform standard LLM-based agents, improving Sharpe ratios across multiple equities. Our results show that combining LLMs with agentic model discovery enhances market risk estimation and enables more profitable trading decisions.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research deploys large language models (LLMs) within an agentic framework to iteratively discover stochastic differential equations (SDEs) for financial time series, generating risk metrics for trading decisions. It evaluates the system using traditional backtests and a market simulator, Simudyne Horizon, which introduces synthetic but causally plausible price paths and news events.

Key Results

- Model-informed trading strategies outperform standard LLM-based agents, improving Sharpe ratios across multiple equities.

- LLMs combined with agentic model discovery enhance market risk estimation and enable more profitable trading decisions.

- Sonnet3.7 (Anthropic) consistently outperforms other LLMs in identifying reasonable candidate functions for risk analysis by several orders of magnitude.

- On average, the model discovery loop enhances the Sharpe ratio of trading strategies by approximately 37%.

- Most LLMs outperform a simple buy-and-hold strategy, especially when incorporating model discovery and risk/trend metrics.

Significance

This research demonstrates the potential of LLMs in an agentic trading framework, leading to improved trading performance and highlighting the semi-automated construction of an epistemic loop where discovery, simulation, and judgement co-evolve.

Technical Contribution

The paper presents a novel approach to utilizing LLMs for automated model development in quantitative risk analysis for financial markets, demonstrating their ability to accurately determine the form of a target SDE.

Novelty

This work is the first to apply LLM-based model development to quantitative risk analysis for financial markets, showcasing a methodology for LLMs to make trading decisions by integrating model-aware risk quantification partially automated by LLMs.

Limitations

- The study does not explicitly address the implications of such systems in the context of black swan events.

- Performance deficits between choosing an SDE model with low calibration loss and making profitable trades suggest the complexity of the multi-component agentic framework.

Future Work

- Investigate the advantages of using different LLMs for specific sub-tasks within a comprehensive agentic trading framework.

- Explore the potential of smaller, fine-tuned models for financial analysis and trading systems.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTo Trade Or Not To Trade: Cascading Waterfall Round Robin Rebalancing Mechanism for Cryptocurrencies

Ravi Kashyap

To Hedge or Not to Hedge: Optimal Strategies for Stochastic Trade Flow Management

Philippe Bergault, Olivier Guéant, Hamza Bodor

Trade in Minutes! Rationality-Driven Agentic System for Quantitative Financial Trading

Dongsheng Li, Xiaohua Wang, Junyao Gao et al.

Trading Prophets: How to Trade Multiple Stocks Optimally

Rohit Vaish, Ashish Chiplunkar, Surbhi Rajput

No citations found for this paper.

Comments (0)