Summary

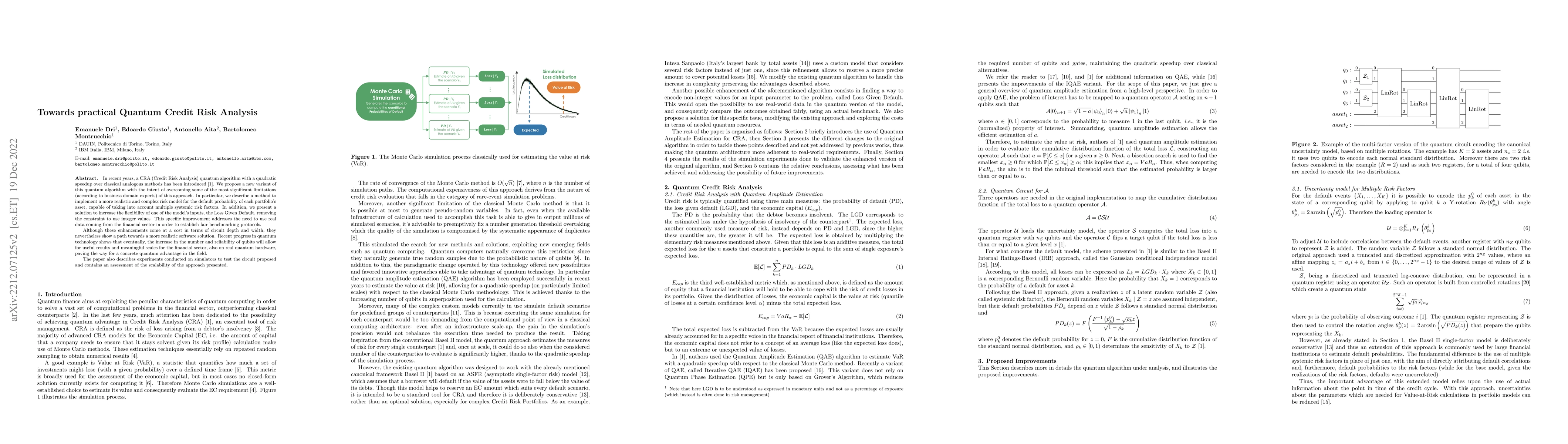

In recent years, a CRA (Credit Risk Analysis) quantum algorithm with a quadratic speedup over classical analogous methods has been introduced. We propose a new variant of this quantum algorithm with the intent of overcoming some of the most significant limitations (according to business domain experts) of this approach. In particular, we describe a method to implement a more realistic and complex risk model for the default probability of each portfolio's asset, capable of taking into account multiple systemic risk factors. In addition, we present a solution to increase the flexibility of one of the model's inputs, the Loss Given Default, removing the constraint to use integer values. This specific improvement addresses the need to use real data coming from the financial sector in order to establish fair benchmarking protocols. Although these enhancements come at a cost in terms of circuit depth and width, they nevertheless show a path towards a more realistic software solution. Recent progress in quantum technology shows that eventually, the increase in the number and reliability of qubits will allow for useful results and meaningful scales for the financial sector, also on real quantum hardware, paving the way for a concrete quantum advantage in the field. The paper also describes experiments conducted on simulators to test the circuit proposed and contains an assessment of the scalability of the approach presented.

AI Key Findings - Processing

Key findings are being generated. Please check back in a few minutes.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImplementing Credit Risk Analysis with Quantum Singular Value Transformation

Giacomo Ranieri, Davide Corbelletto, Francesca Cibrario et al.

Quantum Powered Credit Risk Assessment: A Novel Approach using hybrid Quantum-Classical Deep Neural Network for Row-Type Dependent Predictive Analysis

Rath Minati, Date Hema

Towards Practical Credit Assignment for Deep Reinforcement Learning

Dmitry Vetrov, Riley Simmons-Edler, Vyacheslav Alipov et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)