Summary

The success of deep learning-based limit order book forecasting models is highly dependent on the quality and the robustness of the input data representation. A significant body of the quantitative finance literature focuses on utilising different deep learning architectures without taking into consideration the key assumptions these models make with respect to the input data representation. In this paper, we highlight the issues associated with the commonly-used representations of limit order book data from both a theoretical and practical perspectives. We also show the fragility of the representations under adversarial perturbations and propose two simple modifications to the existing representations that match the theoretical assumptions of deep learning models. Finally, we show experimentally how our proposed representations lead to state-of-the-art performance in both accuracy and robustness utilising very simple neural network architectures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

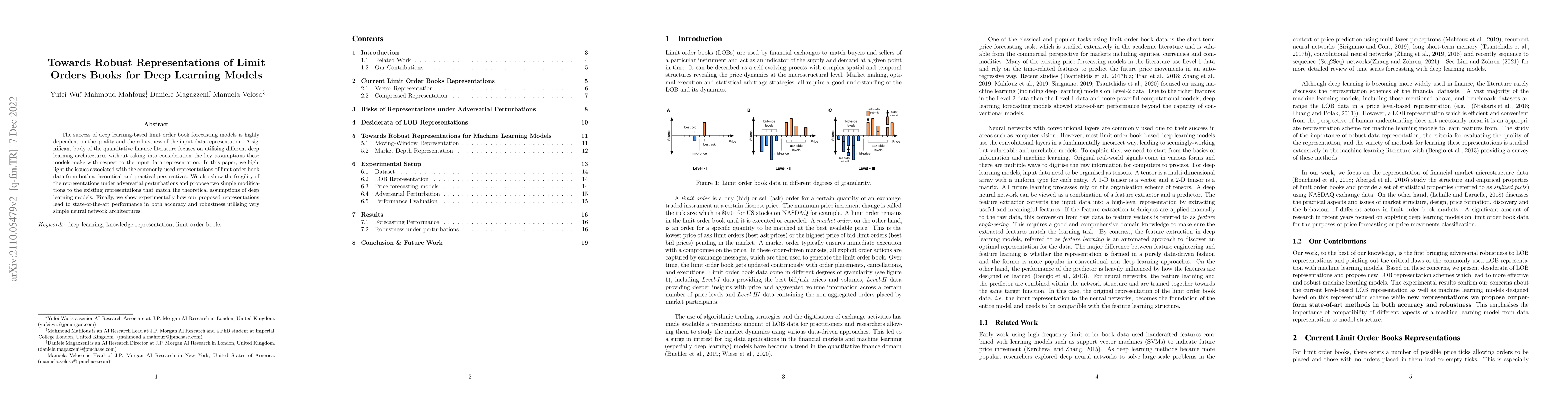

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)