Authors

Summary

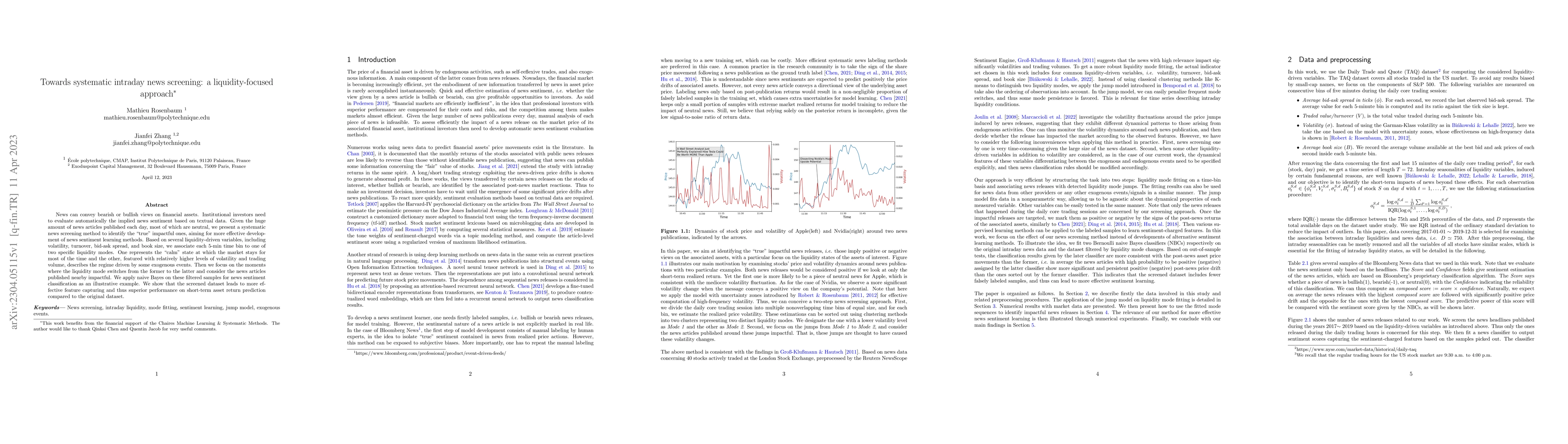

News can convey bearish or bullish views on financial assets. Institutional investors need to evaluate automatically the implied news sentiment based on textual data. Given the huge amount of news articles published each day, most of which are neutral, we present a systematic news screening method to identify the ``true'' impactful ones, aiming for more effective development of news sentiment learning methods. Based on several liquidity-driven variables, including volatility, turnover, bid-ask spread, and book size, we associate each 5-min time bin to one of two specific liquidity modes. One represents the ``calm'' state at which the market stays for most of the time and the other, featured with relatively higher levels of volatility and trading volume, describes the regime driven by some exogenous events. Then we focus on the moments where the liquidity mode switches from the former to the latter and consider the news articles published nearby impactful. We apply naive Bayes on these filtered samples for news sentiment classification as an illustrative example. We show that the screened dataset leads to more effective feature capturing and thus superior performance on short-term asset return prediction compared to the original dataset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBattery valuation on electricity intraday markets with liquidity costs

Xavier Warin, Enzo Cognéville, Thomas Deschatre

No citations found for this paper.

Comments (0)