Authors

Summary

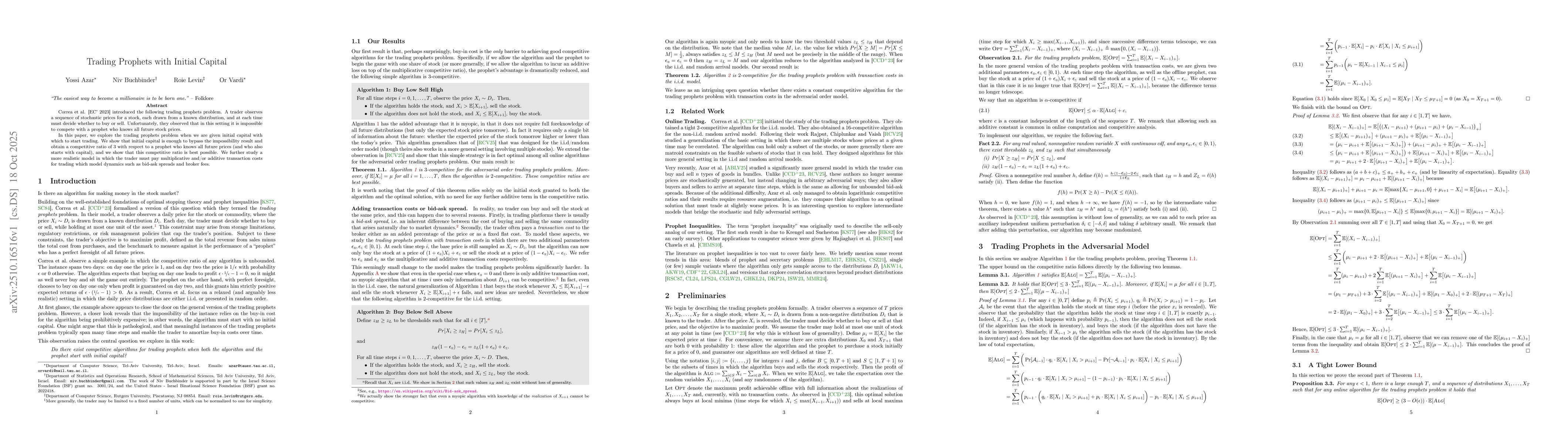

Correa et al. [EC' 2023] introduced the following trading prophets problem. A trader observes a sequence of stochastic prices for a stock, each drawn from a known distribution, and at each time must decide whether to buy or sell. Unfortunately, they observed that in this setting it is impossible to compete with a prophet who knows all future stock prices. In this paper, we explore the trading prophets problem when we are given initial capital with which to start trading. We show that initial capital is enough to bypass the impossibility result and obtain a competitive ratio of $3$ with respect to a prophet who knows all future prices (and who also starts with capital), and we show that this competitive ratio is best possible. We further study a more realistic model in which the trader must pay multiplicative and/or additive transaction costs for trading which model dynamics such as bid-ask spreads and broker fees.

AI Key Findings

Generated Oct 28, 2025

Methodology

The research employs a combination of theoretical analysis and algorithm design to address the trading prophets problem, focusing on competitive algorithms with and without transaction costs.

Key Results

- An optimal 3-competitive algorithm is presented for the original trading prophets problem.

- A 2-competitive algorithm is developed for a harder version with transaction costs and i.i.d. prices.

- The study demonstrates that allowing an additive term in the competitive ratio or starting with an initial stock bypasses the impossibility theorem.

Significance

This work advances competitive analysis in online algorithms, providing practical solutions for dynamic trading scenarios and opening new avenues for algorithmic trading strategies.

Technical Contribution

The paper introduces novel algorithmic techniques and competitive analysis frameworks for trading prophets problems, including handling transaction costs and initial stock possession.

Novelty

The work's novelty lies in bypassing prior impossibility results through additive terms in competitive ratios and initial stock possession, offering practical solutions for online trading algorithms.

Limitations

- The results are primarily theoretical and may not directly translate to real-world market conditions.

- The analysis assumes i.i.d. price distributions, which may not hold in all practical scenarios.

Future Work

- Exploring competitive algorithms in adversarial (non-i.i.d.) settings with transaction costs.

- Generalizing results to multiple commodity settings or intermediate models between i.i.d. and fully adversarial.

Paper Details

PDF Preview

Similar Papers

Found 5 papersTrading Prophets: How to Trade Multiple Stocks Optimally

Rohit Vaish, Ashish Chiplunkar, Surbhi Rajput

Comments (0)