Summary

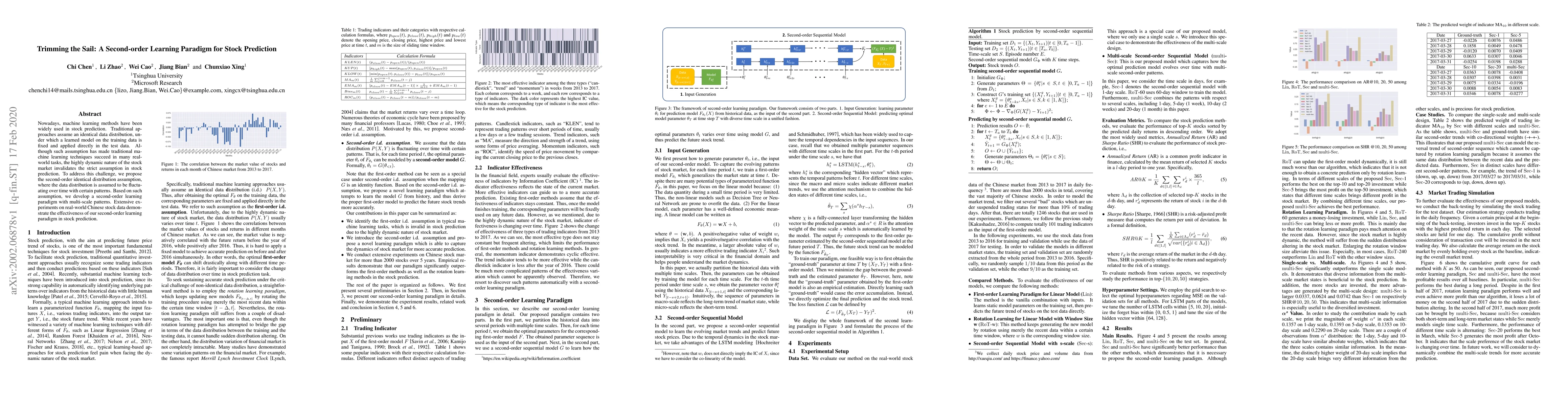

Nowadays, machine learning methods have been widely used in stock prediction. Traditional approaches assume an identical data distribution, under which a learned model on the training data is fixed and applied directly in the test data. Although such assumption has made traditional machine learning techniques succeed in many real-world tasks, the highly dynamic nature of the stock market invalidates the strict assumption in stock prediction. To address this challenge, we propose the second-order identical distribution assumption, where the data distribution is assumed to be fluctuating over time with certain patterns. Based on such assumption, we develop a second-order learning paradigm with multi-scale patterns. Extensive experiments on real-world Chinese stock data demonstrate the effectiveness of our second-order learning paradigm in stock prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeta-Stock: Task-Difficulty-Adaptive Meta-learning for Sub-new Stock Price Prediction

Qianli Ma, Zhen Liu, Linghao Wang et al.

Machine Learning for Stock Prediction Based on Fundamental Analysis

Luiz Fernando Capretz, Yuxuan Huang, Danny Ho

No citations found for this paper.

Comments (0)