Authors

Summary

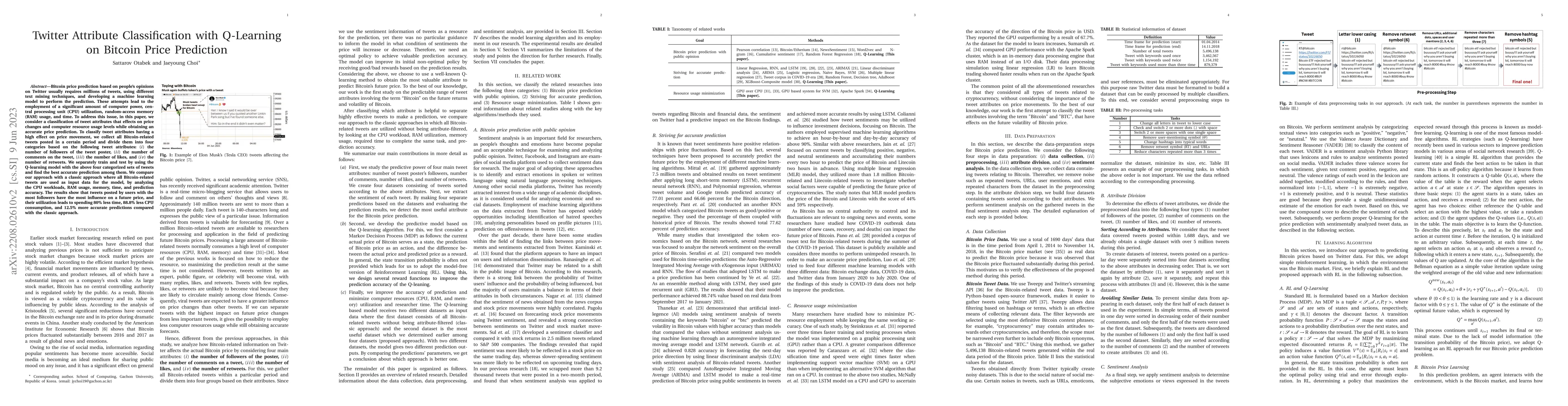

Aspiring to achieve an accurate Bitcoin price prediction based on people's opinions on Twitter usually requires millions of tweets, using different text mining techniques (preprocessing, tokenization, stemming, stop word removal), and developing a machine learning model to perform the prediction. These attempts lead to the employment of a significant amount of computer power, central processing unit (CPU) utilization, random-access memory (RAM) usage, and time. To address this issue, in this paper, we consider a classification of tweet attributes that effects on price changes and computer resource usage levels while obtaining an accurate price prediction. To classify tweet attributes having a high effect on price movement, we collect all Bitcoin-related tweets posted in a certain period and divide them into four categories based on the following tweet attributes: $(i)$ the number of followers of the tweet poster, $(ii)$ the number of comments on the tweet, $(iii)$ the number of likes, and $(iv)$ the number of retweets. We separately train and test by using the Q-learning model with the above four categorized sets of tweets and find the best accurate prediction among them. Especially, we design several reward functions to improve the prediction accuracy of the Q-leaning. We compare our approach with a classic approach where all Bitcoin-related tweets are used as input data for the model, by analyzing the CPU workloads, RAM usage, memory, time, and prediction accuracy. The results show that tweets posted by users with the most followers have the most influence on a future price, and their utilization leads to spending 80\% less time, 88.8\% less CPU consumption, and 12.5\% more accurate predictions compared with the classic approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPreBit -- A multimodal model with Twitter FinBERT embeddings for extreme price movement prediction of Bitcoin

Dorien Herremans, Yanzhao Zou

| Title | Authors | Year | Actions |

|---|

Comments (0)