Summary

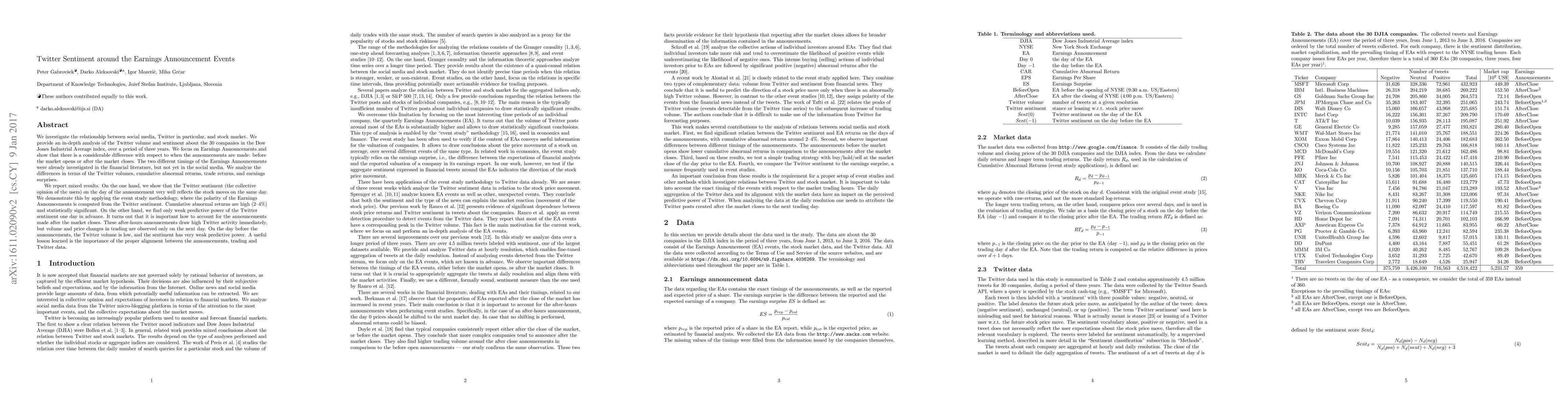

We investigate the relationship between social media, Twitter in particular, and stock market. We provide an in-depth analysis of the Twitter volume and sentiment about the 30 companies in the Dow Jones Industrial Average index, over a period of three years. We focus on Earnings Announcements and show that there is a considerable difference with respect to when the announcements are made: before the market opens or after the market closes. The two different timings of the Earnings Announcements were already investigated in the financial literature, but not yet in the social media. We analyze the differences in terms of the Twitter volumes, cumulative abnormal returns, trade returns, and earnings surprises. We report mixed results. On the one hand, we show that the Twitter sentiment (the collective opinion of the users) on the day of the announcement very well reflects the stock moves on the same day. We demonstrate this by applying the event study methodology, where the polarity of the Earnings Announcements is computed from the Twitter sentiment. Cumulative abnormal returns are high (2--4\%) and statistically significant. On the other hand, we find only weak predictive power of the Twitter sentiment one day in advance. It turns out that it is important how to account for the announcements made after the market closes. These after-hours announcements draw high Twitter activity immediately, but volume and price changes in trading are observed only on the next day. On the day before the announcements, the Twitter volume is low, and the sentiment has very weak predictive power. A useful lesson learned is the importance of the proper alignment between the announcements, trading and Twitter data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtracting the Structure of Press Releases for Predicting Earnings Announcement Returns

Yuntao Wu, Vincent Grégoire, Andreas Veneris et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)