Summary

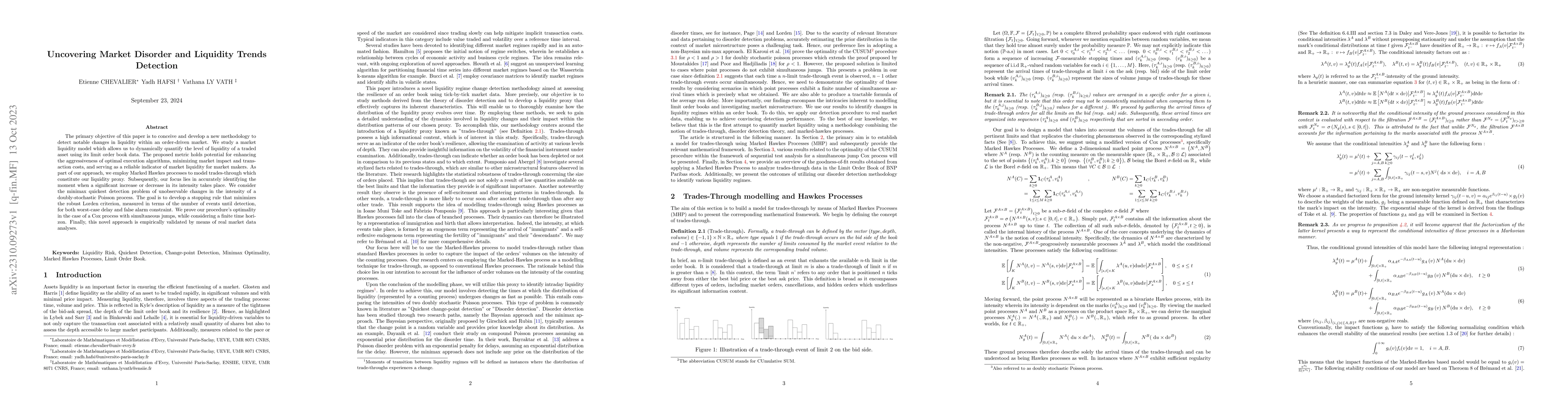

The primary objective of this paper is to conceive and develop a new methodology to detect notable changes in liquidity within an order-driven market. We study a market liquidity model which allows us to dynamically quantify the level of liquidity of a traded asset using its limit order book data. The proposed metric holds potential for enhancing the aggressiveness of optimal execution algorithms, minimizing market impact and transaction costs, and serving as a reliable indicator of market liquidity for market makers. As part of our approach, we employ Marked Hawkes processes to model trades-through which constitute our liquidity proxy. Subsequently, our focus lies in accurately identifying the moment when a significant increase or decrease in its intensity takes place. We consider the minimax quickest detection problem of unobservable changes in the intensity of a doubly-stochastic Poisson process. The goal is to develop a stopping rule that minimizes the robust Lorden criterion, measured in terms of the number of events until detection, for both worst-case delay and false alarm constraint. We prove our procedure's optimality in the case of a Cox process with simultaneous jumps, while considering a finite time horizon. Finally, this novel approach is empirically validated by means of real market data analyses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSILS: Strategic Influence on Liquidity Stability and Whale Detection in Concentrated-Liquidity DEXs

Amirfarhad Farhadi, Azadeh Zamanifar, Ali RajabiNekoo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)