Summary

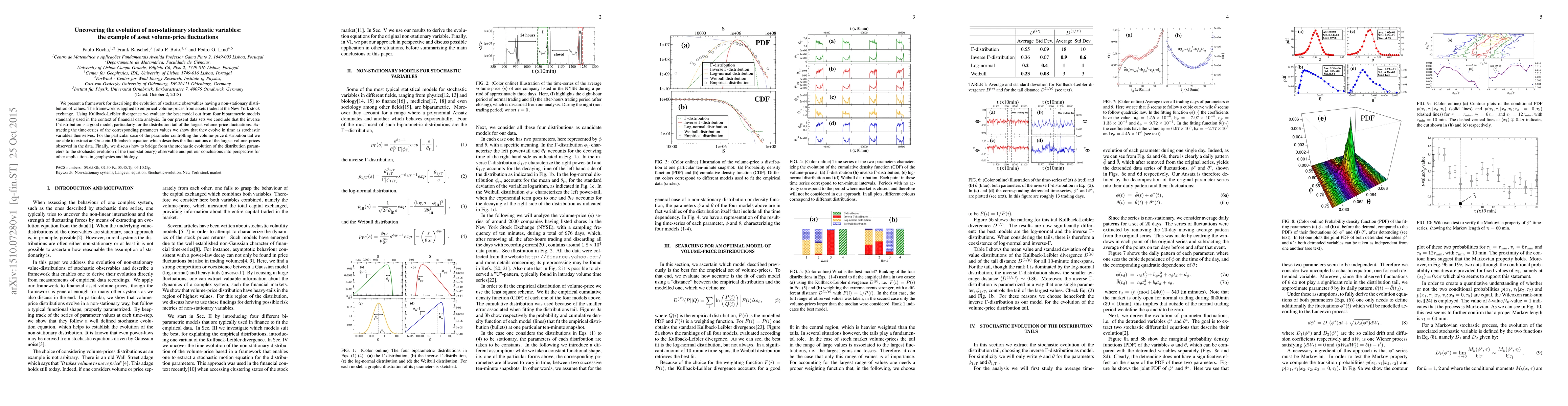

We present a framework for describing the evolution of stochastic observables having a non-stationary distribution of values. The framework is applied to empirical volume-prices from assets traded at the New York stock exchange. Using Kullback-Leibler divergence we evaluate the best model out from four biparametric models standardly used in the context of financial data analysis. In our present data sets we conclude that the inverse $\Gamma$-distribution is a good model, particularly for the distribution tail of the largest volume-price fluctuations. Extracting the time-series of the corresponding parameter values we show that they evolve in time as stochastic variables themselves. For the particular case of the parameter controlling the volume-price distribution tail we are able to extract an Ornstein-Uhlenbeck equation which describes the fluctuations of the largest volume-prices observed in the data. Finally, we discuss how to bridge from the stochastic evolution of the distribution parameters to the stochastic evolution of the (non-stationary) observable and put our conclusions into perspective for other applications in geophysics and biology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)